Advisors continue to represent an important distribution channel for term assurance, with GlobalData’s 2021 UK Insurance Consumer Survey showing that 46.3% of individuals bought their mortgage-related term assurance policy through an advisor or broker, while a further 9.8% did so through a bank. Buying a property is one of the biggest drivers of term assurance purchases. With advisors guiding consumers as to the benefits of protection, there is hope that the protection gap can be closed.

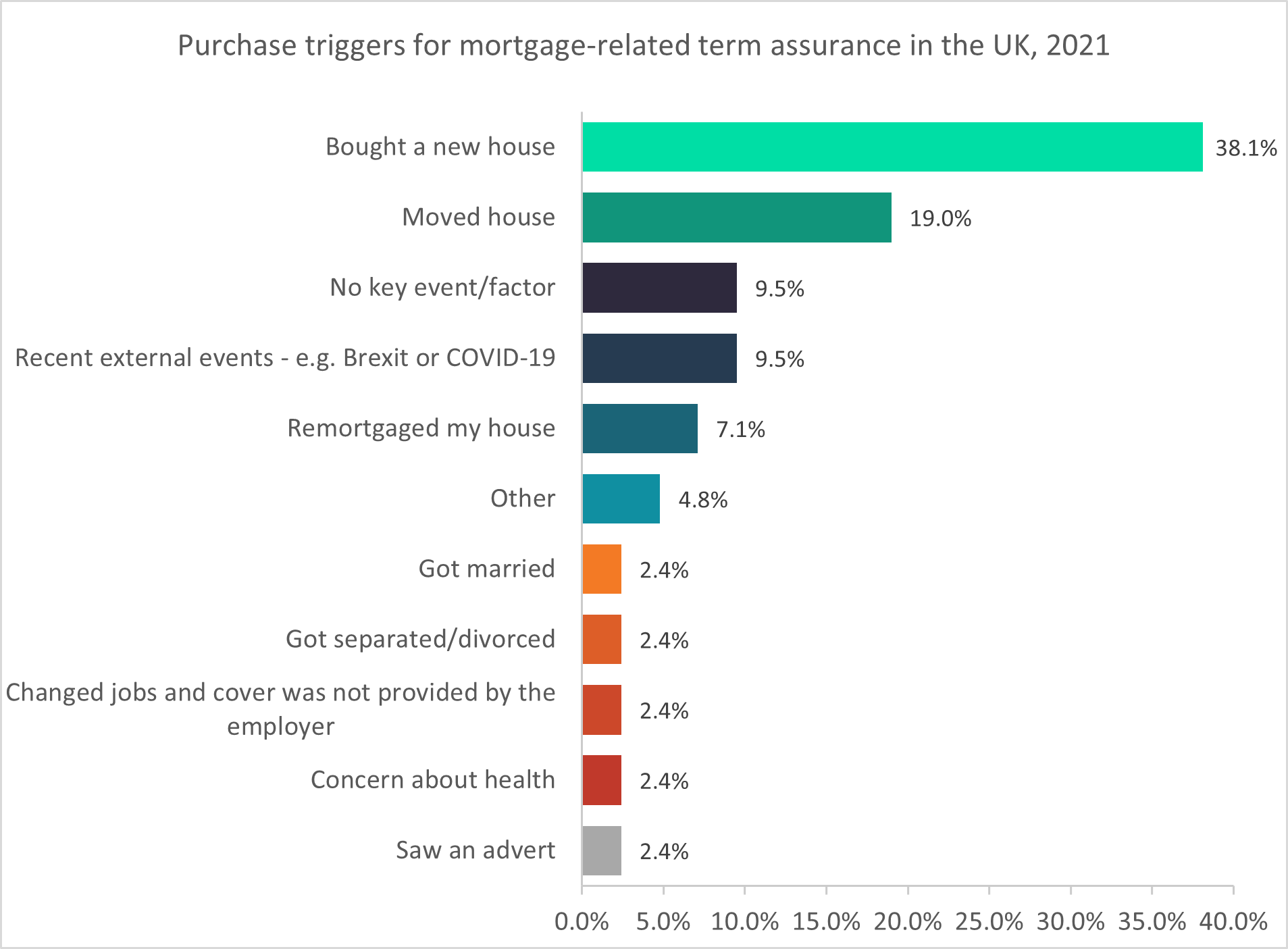

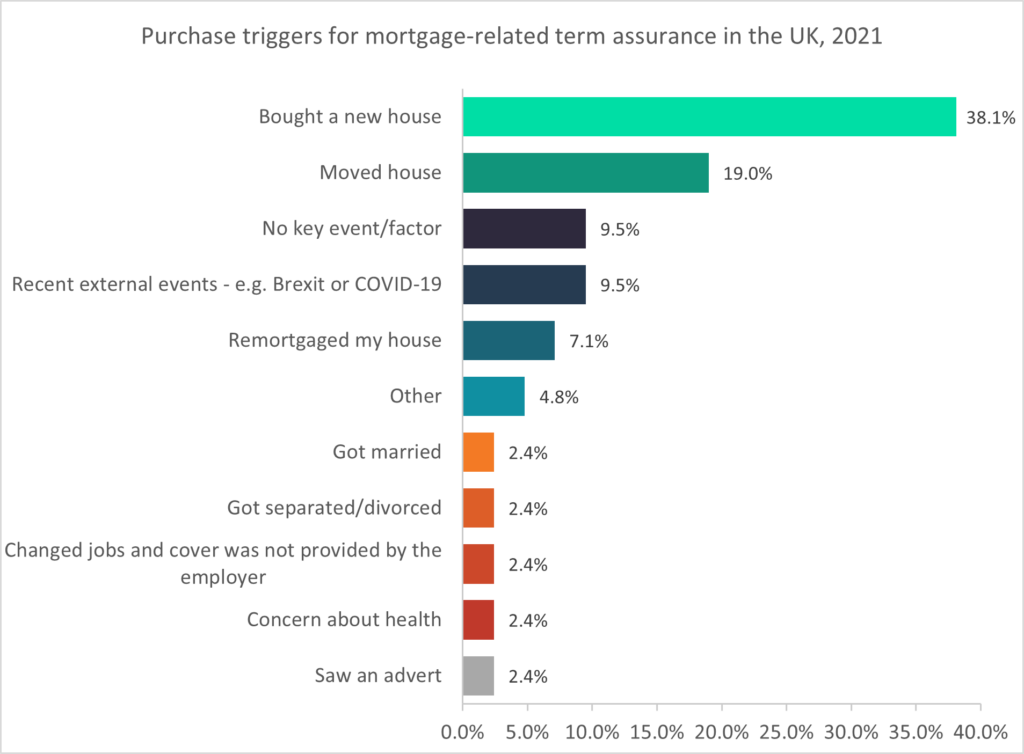

According to GlobalData’s 2021 UK Insurance Consumer Survey, 38.1% of mortgage-related term assurance customers purchased their policy due to buying a home. Additionally, 19.0% acquired mortgage-related term assurance after moving house. This demonstrates the significance of mortgages as a motivator of protection purchases for people across the UK. In addition, GlobalData discovered that 64.3% of people buying mortgage-related term assurance desired cover for the duration of their mortgage, once again stressing the importance of protection for individuals who are on the property ladder.

Given that buying a property has such weight in the decision-making process of taking out term assurance – coupled with the fact that advisors play such an important role in the distribution of these products – it is only normal for them to streamline their processes. As such, national mortgage and insurance network Stonebridge has introduced additional functionality to its wholly-owned trading platform, Revolution. Advisors at certain stages of the mortgage journey are guided in writing protection themselves, without the need for Stonebridge to get involved, in an effort to generate more sales. If they are unable to create a protection policy themselves, the client is referred to Stonebridge Protect via the new functionality.

The Financial Conduct Authority’s (FCA’s) Consumer Duty regulations (which will go into force around April 2023) will place strong emphasis on ensuring that advisors always act in their clients’ best interests. Higher standards of care for customers of mortgage and protection advisors will be required as a result. Additionally, in its Financial Lives 2020 survey the FCA outlined that 53% of UK individuals have no protection products, producing a significant gap in the market. As mortgages are the key trigger for the purchase of term assurance, mortgage advisors can help close the protection gap by offering term assurance as part of their discussions with customers. Furthermore, amid the cost-of-living crisis the importance of protection products must be highlighted. In a scenario where an individual falls seriously ill and cannot pay their mortgage, a protection policy would offer cover. Incorporating protection discussions when advising about mortgages will contribute to an increase in the number of sales in the protection space, in turn closing the protection gap.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData