Small businesses in the UK are extremely concerned about the ongoing cost-of-living crisis and so are insurers. The level of worry is so high that it indicates many businesses may not make it through this difficult period. The health of the SME insurance market is dependent on the number of SMEs in the country, so if liquidations start to rise then the number and value of insurance contracts will decline. Meanwhile, SMEs that do survive will have to severely reduce their expenses, which may include insurance policies. This will be damaging to commercial insurers in the UK.

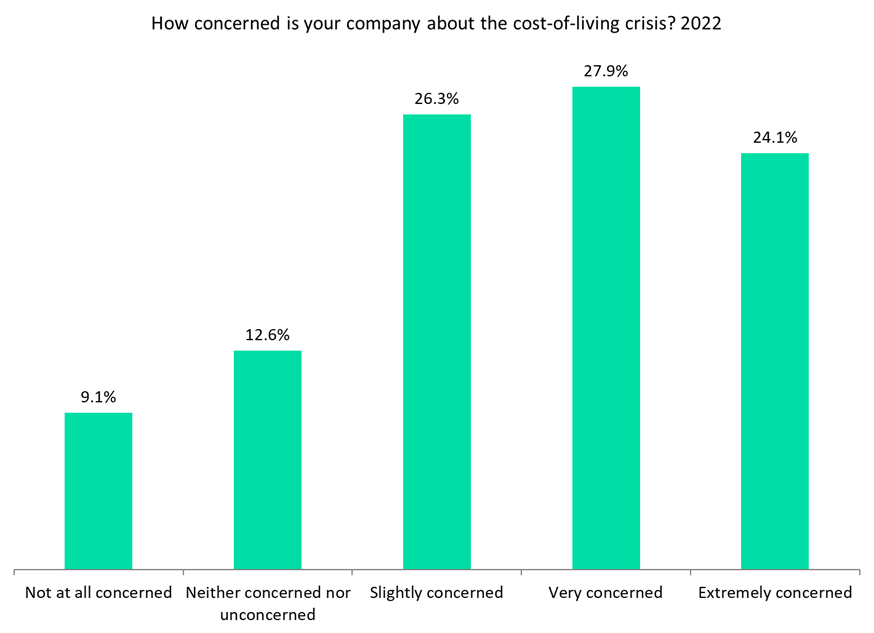

GlobalData’s 2022 UK SME Insurance Survey found that 78.3% of SMEs in the UK were concerned to some extent about the ongoing cost-of-living crisis, with 52% either “very concerned” or “extremely concerned.” The situation is showing no signs of coming to an end, with the Russia/Ukraine conflict continuing and inflation and energy prices still sky high. On top of rising inflation, consumers are facing higher mortgage rates, which will impact both homeowners and renters (as landlords will be likely to raise rents). Therefore, consumers will have less disposable income to spend, which will further impact SMEs.

Insurers will need to make sure their penetration rates do not drop, despite the number of businesses in the country being likely to see a decline due to the cost-of-living crisis. However, it will be extremely difficult for them to achieve this while pushing through premium increases, as insurers’ own costs will have increased this year. SMEs will look to cut bills; taking on more risk by being underinsured in areas where perceived risk is lower is one way they might go about this.

Insurers may need to focus on maintaining customers, even if that does result in profit declining in the short term. Offering flexible insurance to keep customers on board could be a temporary solution. Payment holidays and flexible payment terms were used during the COVID-19 pandemic; they could be brought back to help businesses through these tough times. This would allow customers to switch certain policies off and on in order to manage exactly what they pay, which for insurers is likely a better solution than losing the customer altogether. This is particularly possible in motor insurance, where pay-per-mile and pay-as-you-drive insurance are becoming more commonplace in the commercial line. It could also be applicable to insurance for contents or equipment.

It will be a tough year for insurers in the SME market, with the level of concern extremely high. Insurers that innovate – or at least communicate well with clients – will be most likely to complete increasingly difficult renewals.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData