Car usage returning to pre-COVID levels looks increasingly unlikely as people continue to work from home much more frequently than they did before the start of the pandemic. According to GlobalData’s 2022 UK Insurance Consumer Survey, more than half of employees do not anticipate returning to work full-time following the pandemic. This suggests that usage-based insurance (UBI) policies should be more relevant to the motor insurance sector. At present take-up remains low, but as the cost-of-living crisis intensifies UBI and pay-per-mile policies will be a viable option for low-mileage drivers to reduce their expenditure.

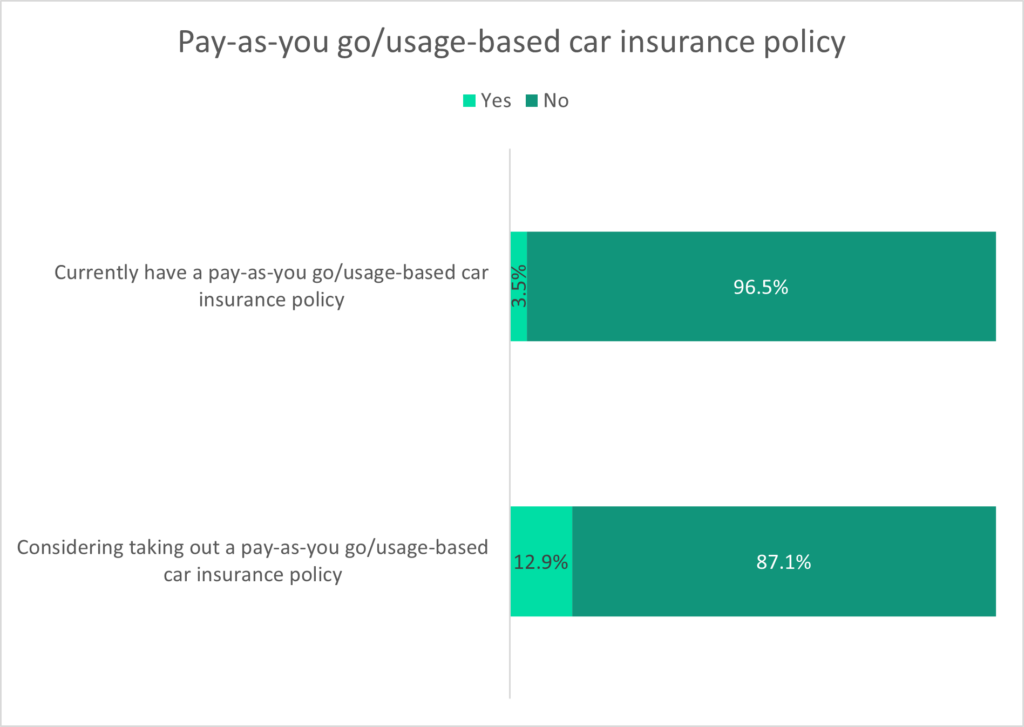

GlobalData’s 2022 survey found that only 3.5% of consumers currently have a pay-as-you-go/UBI policy, highlighting slow uptake and a lack of awareness of the benefits these policies provide. Yet 12.9% of individuals said they would consider the option – up from 8.5% in 2021. This shows there is growing interest in such products. Going forward, widespread adoption will depend on how well insurers can communicate the benefits of these policies.

Since people are working from home more frequently than they did before the pandemic, average annual mileage has fallen. Department for Transport data shows that the average UK driver’s annual mileage dropped from 7,400 miles in 2019 to 5,300 miles in 2021. To address this trend, insurers are introducing pay-per-mile and UBI solutions. For example, Ticker’s pay-per-mile insurance offers better pricing for drivers who log fewer miles per year. Meanwhile, its app provides customers a clear view of their daily travel expenses by tracking the cost of each journey. Both aspects of this policy will help consumers cope with the cost-of-living crisis.

The demand for more flexible car insurance policies will increase if driving levels continue to fall. As consumer understanding of UBI policies increases and consumers become more aware of the advantages such policies provide for infrequent drivers, UBI will become more and more appealing. Insurers are continuing to launch products that cater to the needs of consumers in response to the cost-of-living crisis, such as Marmalade – a leader in traditional black box telematics policies – moving into the pay-per-mile market for the first time. This will undoubtedly cause more competition but at the same time will increase consumers’ awareness of UBI policies, improving availability for those seeking such a product.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData