The insurance industry continues to be a hotbed of innovation, with activity driven by growing demand for digitalization and personalization. With growing importance of technologies such as telematics, machine learning, big data, deep learning, and data science, insurers are overcoming demographic challenges, low penetration rates, cybercrimes, and fraudulent claims. In the last three years alone, there have been over 11,000 patents filed and granted in the insurance industry, according to GlobalData’s report on Artificial intelligence in Insurance: Insurance recommendation models. Buy the report here.

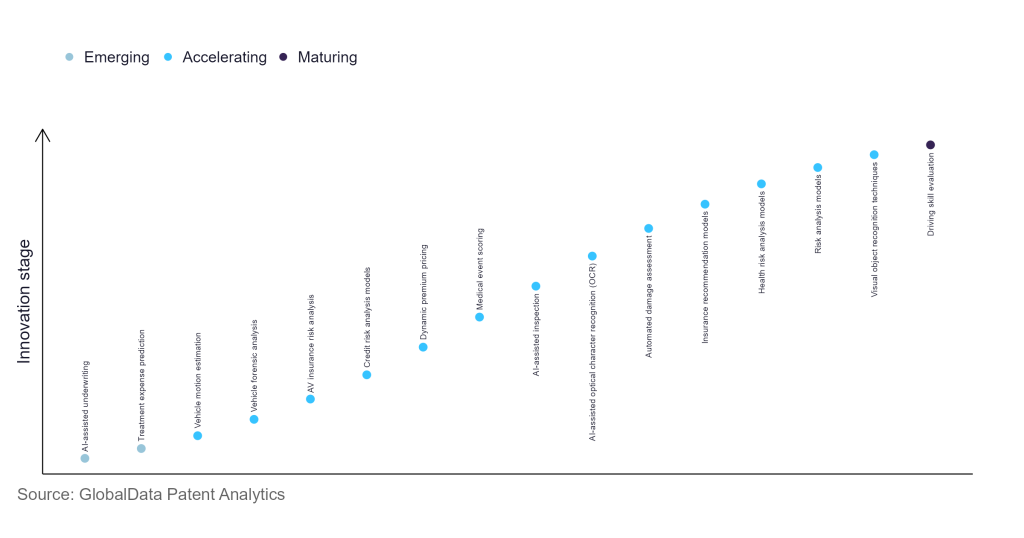

However, not all innovations are equal and nor do they follow a constant upward trend. Instead, their evolution takes the form of an S-shaped curve that reflects their typical lifecycle from early emergence to accelerating adoption, before finally stabilising and reaching maturity.

Identifying where a particular innovation is on this journey, especially those that are in the emerging and accelerating stages, is essential for understanding their current level of adoption and the likely future trajectory and impact they will have.

90 innovations will shape the insurance industry

According to GlobalData’s Technology Foresights, which plots the S-curve for the insurance industry using innovation intensity models built on over 65,000 patents, there are 90 innovation areas that will shape the future of the industry.

Within the emerging innovation stage, AI-assisted underwriting and treatment expense prediction are disruptive technologies that are in the early stages of application and should be tracked closely. Vehicle motion estimation, vehicle forensic analysis, and AV insurance risk analysis are some of the accelerating innovation areas, where adoption has been steadily increasing. Among maturing innovation areas is driving skill evaluation, which is now well established in the industry.

Innovation S-curve for artificial intelligence in the insurance industry

Insurance recommendation models is a key innovation area in artificial intelligence

Insurance recommendation systems are machine learning algorithms that recommend insurance products to existing and new customers. They are used to provide personalized recommendations to customers based on what other people with similar portfolios have, to ensure they have adequate coverage for their needs. In addition to customer portfolio data, insurance recommendation systems use customer characteristics to prompt recommendable products. There are two types of insurance recommendation systems: personalized and non-personalized. Due to their high level of consumer engagement and potential cost-saving and investment opportunities, personalized recommenders are gaining popularity.

These models use AI algorithms to assess a large amount of consumer data, including prior behavior and demographics, and provide recommendations for policies and coverage alternatives that are specifically customized to the needs of the customer.

GlobalData’s analysis also uncovers the companies at the forefront of each innovation area and assesses the potential reach and impact of their patenting activity across different applications and geographies. According to GlobalData, there are 30 companies, spanning technology vendors, established insurance companies, and up-and-coming start-ups engaged in the development and application of insurance recommendation models.

Key players in insurance recommendation models – a disruptive innovation in the insurance industry

‘Application diversity’ measures the number of different applications identified for each relevant patent and broadly splits companies into either ‘niche’ or ‘diversified’ innovators.

‘Geographic reach’ refers to the number of different countries each relevant patent is registered in and reflects the breadth of geographic application intended, ranging from ‘global’ to ‘local’.

Patent volumes related to insurance recommendation models

| Company | Total patents (2010 - 2022) | Premium intelligence on the world's largest companies |

| Ping An Insurance (Group) Company of China | 322 | Unlock Company Profile |

| SoftBank Group | 283 | Unlock Company Profile |

| State Farm Mutual Automobile Insurance | 94 | Unlock Company Profile |

| Taikang Insurance Group | 35 | Unlock Company Profile |

| USAA | 32 | Unlock Company Profile |

| Tractable | 24 | Unlock Company Profile |

| Clearlake Capital Group | 20 | Unlock Company Profile |

| Addepar | 17 | Unlock Company Profile |

| Ant Group | 15 | Unlock Company Profile |

| Baidu | 14 | Unlock Company Profile |

| Accenture | 13 | Unlock Company Profile |

| Mitchell International | 12 | Unlock Company Profile |

| NetraDyne | 12 | Unlock Company Profile |

| Yembo | 9 | Unlock Company Profile |

| Cox Enterprises | 9 | Unlock Company Profile |

| American International Group (AIG) | 9 | Unlock Company Profile |

| LyondellBasell Industries | 8 | Unlock Company Profile |

| Mile Auto | 8 | Unlock Company Profile |

| Vista Equity Partners | 7 | Unlock Company Profile |

| Zendrive | 7 | Unlock Company Profile |

| China Life Insurance (Group) Company | 6 | Unlock Company Profile |

| Pearl | 6 | Unlock Company Profile |

| Beijing Qiyu Technology | 6 | Unlock Company Profile |

| Cerebri AI | 6 | Unlock Company Profile |

| China Investment | 5 | Unlock Company Profile |

| Dareway Software | 5 | Unlock Company Profile |

| Sunshine Insurance Group | 5 | Unlock Company Profile |

| Sony Group | 5 | Unlock Company Profile |

| Commonwealth Scientific and Industrial Research Organisation | 5 | Unlock Company Profile |

| Dalian Roiland Technology | 5 | Unlock Company Profile |

Source: GlobalData Patent Analytics

Ping An Insurance is a top patent filer in insurance recommendation models. The insurer has developed a device that incorporates AI for recommending insurance products. The process includes querying insurance data, matching products based on historical data, analysing the insurance products, calculating the matching degree between the insurance products and the user, and selecting the insurance product with the highest matching degree as the target insurance product. The target insurance product can also be stored in a blockchain node for added security and transparency.

Some other key patent filers incorporating AI in insurance recommendation models include SoftBank, State Farm Mutual Automobile Insurance, Taikang, and USAA.

In terms of application diversity, NetraDyne leads the pack, with Commonwealth Scientific and Industrial Research Organisation and State Farm Mutual Automobile Insurance in the second and third positions, respectively. By means of geographic reach, Cox Enterprises holds the top position, followed by Vista Equity Partners and Sony Group.

To further understand the key themes and technologies disrupting the insurance industry, access GlobalData’s latest thematic research report on Insurance.

Data Insights

From

The gold standard of business intelligence.

Blending expert knowledge with cutting-edge technology, GlobalData’s unrivalled proprietary data will enable you to decode what’s happening in your market. You can make better informed decisions and gain a future-proof advantage over your competitors.