The insurance industry continues to be a hotbed of patent innovation. Activity is driven by digitalization, personalization, and growing importance of technologies such as artificial intelligence (AI), Internet of Things, and cybersecurity in insurance documentation and data analytics, predictive risk assessment, fraud detection, and smart policy management. In the last three years alone, there have been over 9,000 patents filed and granted in the insurance industry, according to GlobalData’s report on Artificial intelligence in insurance: smart policy management. Buy the report here.

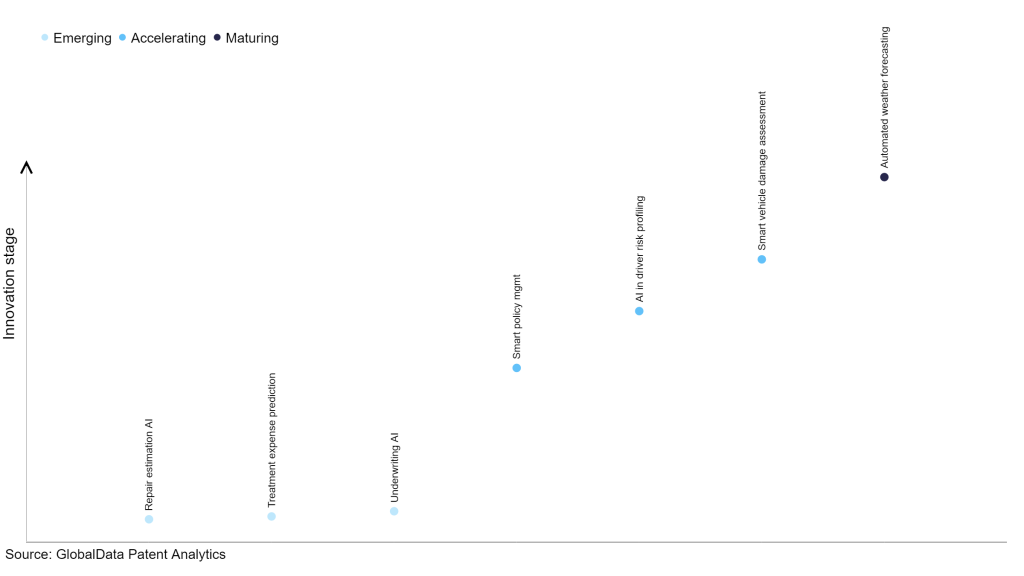

However, not all innovations are equal and nor do they follow a constant upward trend. Instead, their evolution takes the form of an S-shaped curve that reflects their typical lifecycle from early emergence to accelerating adoption, before finally stabilizing and reaching maturity.

Identifying where a particular innovation is on this journey, especially those that are in the emerging and accelerating stages, is essential for understanding their current level of adoption and the likely future trajectory and impact they will have.

25+ innovations will shape the insurance industry

According to GlobalData’s Technology Foresights, which plots the S-curve for the insurance industry using innovation intensity models built on over 75,000 patents, there are 25+ innovation areas that will shape the future of the industry.

Within the emerging innovation stage, underwriting AI, predictive risk analysis, and insurance documentation AI are disruptive technologies that are in the early stages of application and should be tracked closely. Insurance fraud detection AI, smart policy management, and smart vehicle damage assessment are some of the accelerating innovation areas, where adoption has been steadily increasing. Among maturing innovation areas is automated weather forecasting, which is now well established in the industry.

Innovation S-curve for artificial intelligence in the insurance industry

Smart policy management is a key innovation area in artificial intelligence

Smart policy management refers to the use of advanced technologies, such as machine learning and image processing, to automate and optimize various aspects of insurance policy management. It involves the training and use of machine learning models to analyze data, such as images and text, to make informed decisions and perform tasks related to insurance policies. These technologies enable efficient underwriting processes, accurate determination of damage to property, verification of vehicle odometer mileage, submission of insurance claims, generation of insurance data and policies, processing of image data for vehicle damage assessment, and depiction of vehicle information in augmented reality.

GlobalData’s analysis also uncovers the companies at the forefront of each innovation area and assesses the potential reach and impact of their patenting activity across different applications and geographies. According to GlobalData, there are 105+ companies, spanning technology vendors, established insurance companies, and up-and-coming start-ups engaged in the development and application of smart policy management.

Key players in smart policy management – a disruptive innovation in the insurance industry

‘Application diversity’ measures the number of applications identified for each patent. It broadly splits companies into either ‘niche’ or ‘diversified’ innovators.

‘Geographic reach’ refers to the number of countries each patent is registered in. It reflects the breadth of geographic application intended, ranging from ‘global’ to ‘local’.

Patent volumes related to smart policy management

| Company | Total patents (2010 - 2022) | Premium intelligence on the world's largest companies |

| Ping An Insurance (Group) | 85 | Unlock Company Profile |

| Clearlake Capital Group | 81 | Unlock Company Profile |

| State Farm Mutual Automobile Insurance | 35 | Unlock Company Profile |

| Taikang Insurance Group | 31 | Unlock Company Profile |

| Alibaba Group | 20 | Unlock Company Profile |

| Visa | 19 | Unlock Company Profile |

| Paperclip | 19 | Unlock Company Profile |

| The Allstate | 18 | Unlock Company Profile |

| KBC Group | 17 | Unlock Company Profile |

| LyondellBasell Industries | 13 | Unlock Company Profile |

| Ant Group | 12 | Unlock Company Profile |

| Curiteva | 9 | Unlock Company Profile |

| Tempus Labs | 9 | Unlock Company Profile |

| Samsung Life Insurance | 8 | Unlock Company Profile |

| Mitek Systems | 8 | Unlock Company Profile |

| Laboratory Corp of America | 8 | Unlock Company Profile |

| Capital One Financial | 7 | Unlock Company Profile |

| Accenture | 6 | Unlock Company Profile |

| Advanced New Technologies | 5 | Unlock Company Profile |

| The Travelers | 5 | Unlock Company Profile |

| IAA | 5 | Unlock Company Profile |

| First American Financial | 5 | Unlock Company Profile |

| Vehcon | 4 | Unlock Company Profile |

| UnitedHealth Group | 4 | Unlock Company Profile |

| AIMS | 4 | Unlock Company Profile |

| China Merchants Bank | 3 | Unlock Company Profile |

| The Toronto-Dominion Bank | 3 | Unlock Company Profile |

| Bank of America | 3 | Unlock Company Profile |

| China Investment | 3 | Unlock Company Profile |

| USAA | 3 | Unlock Company Profile |

| FMR | 2 | Unlock Company Profile |

| SAP | 2 | Unlock Company Profile |

| Taikang Pension Insurance | 2 | Unlock Company Profile |

| Sunshine Insurance Group | 2 | Unlock Company Profile |

| Fujifilm | 2 | Unlock Company Profile |

| Incar Financial Services | 2 | Unlock Company Profile |

| DataInfoCom USA | 2 | Unlock Company Profile |

| China Ping An Property and Casualty | 2 | Unlock Company Profile |

| Shandong Zhongyang Haigong Construction Engineering | 1 | Unlock Company Profile |

| Shanghai Eye Control Technology | 1 | Unlock Company Profile |

| Mitchell International | 1 | Unlock Company Profile |

| Chengdu Knowledge Vision Technology | 1 | Unlock Company Profile |

| Discovery | 1 | Unlock Company Profile |

| Huawei Investment & Holding | 1 | Unlock Company Profile |

| GMS | 1 | Unlock Company Profile |

| Centene | 1 | Unlock Company Profile |

| The People's Insurance (Group) | 1 | Unlock Company Profile |

| CoreLogic | 1 | Unlock Company Profile |

| Aon | 1 | Unlock Company Profile |

| athenahealth | 1 | Unlock Company Profile |

Source: GlobalData Patent Analytics

Ping An Insurance (Group) Company of China is one of the top patent filers in AI-driven technologies for smart policy management. The company uses advanced AI technologies such as deep learning, data mining, biometric identification, and natural language processing to automate and improve the efficiency of the entire policy management system, from risk assessment and policy underwriting to evidence verification and claims processing.

Some of the other leading innovators in the smart policy management space include Kofax, State Farm Mutual Automobile Insurance, and Taikang Insurance.

In terms of application diversity, Kofax held the top position, while Curiteva and Capital One Financial stood in second and third positions, respectively. By means of geographic reach, Kofax leads the pack, followed by Paperclip and Visa.

To further understand the key themes and technologies disrupting the insurance industry, access GlobalData’s latest thematic research report on Artificial Intelligence (AI) in Insurance.

Data Insights

From

The gold standard of business intelligence.

Blending expert knowledge with cutting-edge technology, GlobalData’s unrivalled proprietary data will enable you to decode what’s happening in your market. You can make better informed decisions and gain a future-proof advantage over your competitors.