The Russia-Ukraine and Israel-Gaza conflicts illustrate how geopolitical tensions are boiling over across regions, leaving consequences and spillovers for the insurance industry to manage. Internal pressures caused through political instability and economic pessimism are also driving increased political risk (PR) and political violence (PV) throughout the world.

The insurance sector is still getting to grips with legal battles and insured losses originating from the Russia-Ukraine conflict. An estimate by Property Claims Services suggests aggregate losses caused by the conflict could exceed $20bn. The lion’s share is likely to be found in the aviation line after the Russian expropriation of planes following the onset of the conflict. Exposures to the marine market relating to ships continuing to operate in the Black Sea and Bosporus Strait have seen rates for war policies harden over 20% since the start of 2023.

As insurers manage exposure to war policies in Israel, price hikes and coverage reductions continue. Israel’s Iron Dome defence system is minimising much of the property damage seen inside the country, moderating insured losses for now. Regional conflagration will exacerbate exposure, with many players wary of continuing to offer standard 12-month policies in the face of growing risks. The marine and energy sectors will also be significantly affected by this worst-case scenario as key shipping routes around the Persian Gulf and major oil and gas assets face disruption and attacks.

Heightened tensions and emotions related to the Israel-Gaza conflict raise the possibility of PV across other countries—especially as the conflict continues and details of the brutality of the fighting emerge. This is most notable in the Arab world but also across major developed economies including the US, the UK, and France.

The past few years have seen considerable damage caused by PV. The French Business Association reported that the July 2023 riots caused approximately $1.1bn in damages. Allianz Global Corporate and Specialty (AGCS) cites the $1.3bn losses caused by damage to infrastructure and lost output in Peru during protests; $1.9bn in claims due to riots in South Africa; and $3bn in economic losses following Colombian anti-government protests. To this end, AGCS now sees PV as a top-ten peril in the industry. In April 2023, the Financial Times reported that civil unrest has led to $10bn in (re)insurance losses since 2015. For context, terrorism-related losses were worth less than $1bn at this time.

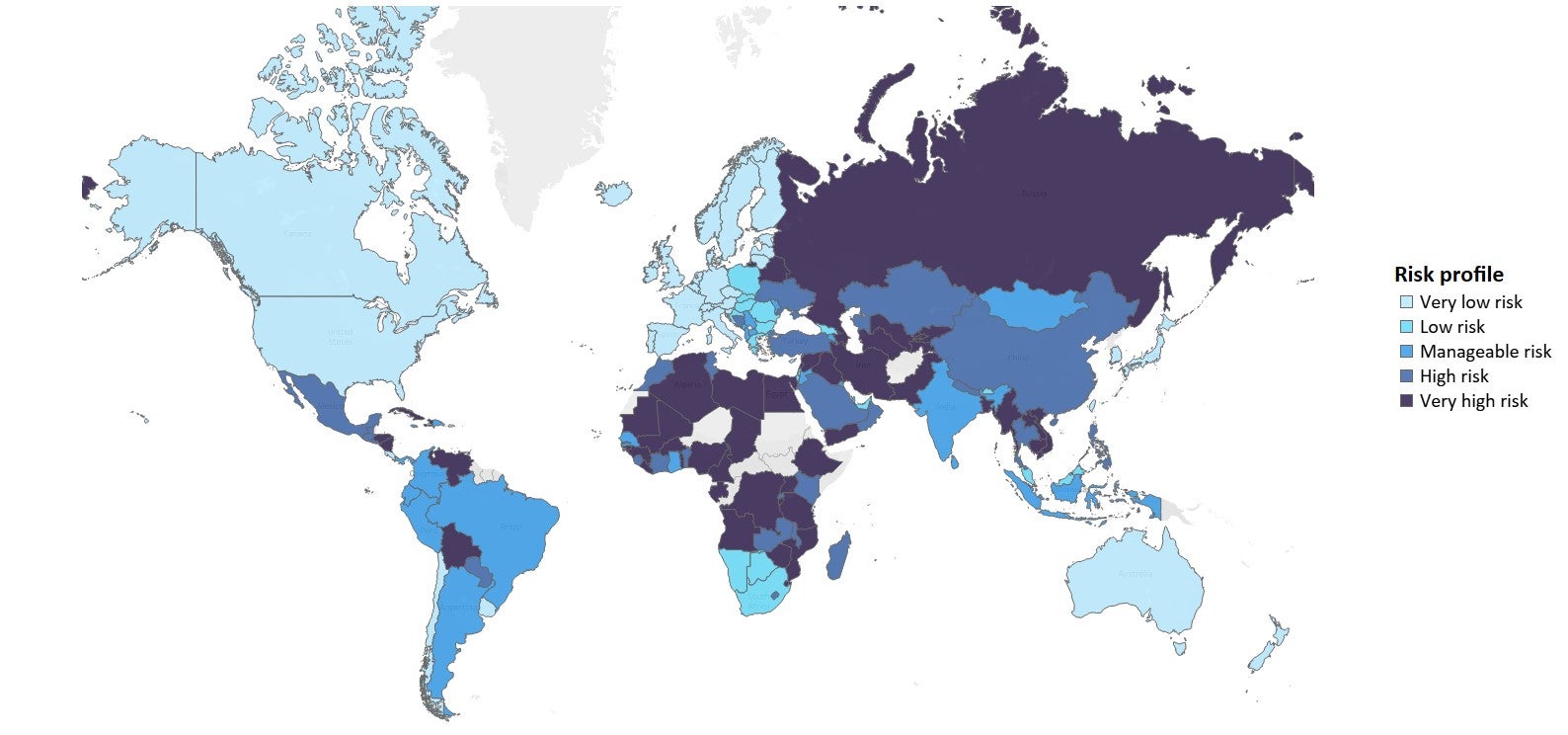

As global tensions grow both domestically and internationally, insurers need to assess exposures to all regions, with extra consideration to the Middle East and, thinking further ahead, potentially Taiwan (Province of China) and the South China Sea. Players that give extra credence to prudent underwriting and diversified exposures will be the ones most likely to weather this new era of geopolitical uncertainty.