Flock has entered a partnership with NIG, which will allow them to target larger fleets more effectively. Meanwhile, GlobalData surveying indicates that among larger fleets, enhanced safety measures rank as the most crucial aspect of usage-based insurance (UBI) policies.

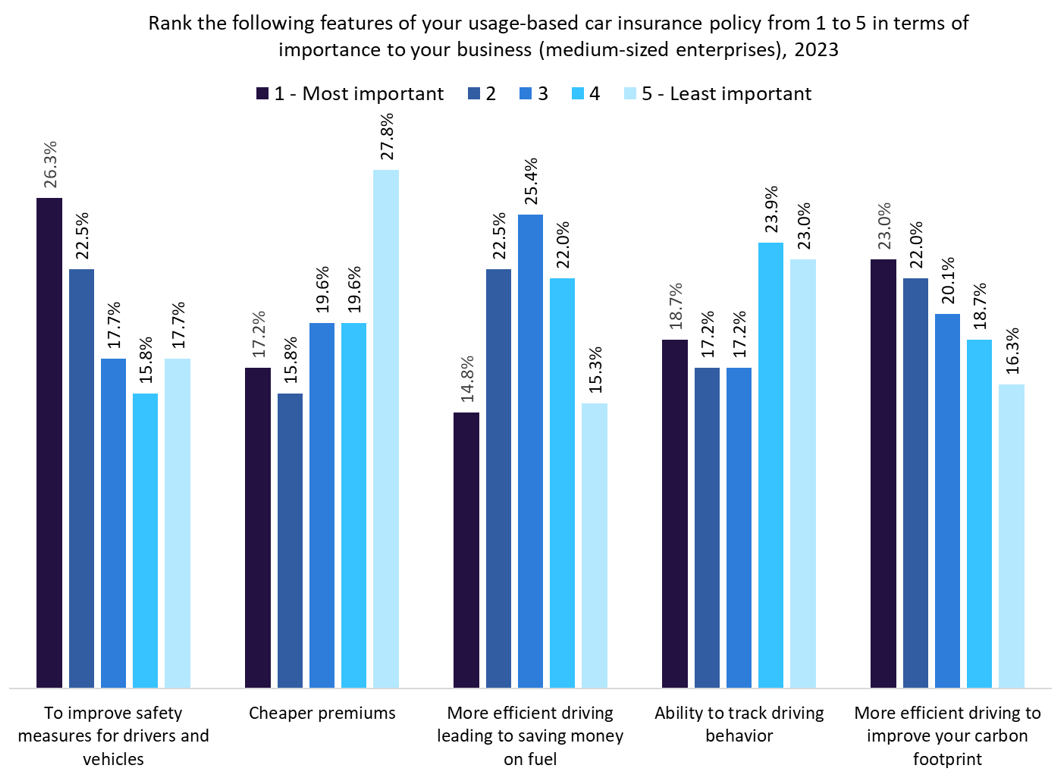

According to GlobalData’s 2023 UK SME Insurance Survey, 26.3% of medium-sized enterprises (with 50–249 employees) prioritise enhanced safety measures as the key feature of a UBI policy. In comparison, this preference is shared by 24.1% of small-sized enterprises, 9.5% of micro-enterprises, and 10.5% of sole traders. Notably, medium-sized companies place a higher value on improved safety features than on lower premiums, with 17.2% ranking cheaper premiums as their most important feature. In contrast, 57.9% of sole traders, 30.2% of micro-businesses, and 18.8% of small companies consider cheaper premiums as the most important aspect of a UBI policy. Moreover, 27.8% of medium-sized enterprises rank cheaper premiums as the least important feature of a UBI policy.

Economic pressures tend to amplify the importance of cost-related considerations, such as seeking cheaper insurance options. However, GlobalData’s survey results indicate a shift in priorities, showcasing a heightened emphasis on safety for medium-sized businesses. This change could be attributed to the growing recognition among larger SMEs of the broader risks and uncertainties associated with their operations. The cost-of-living crisis, marked by inflationary pressures and economic challenges, may have prompted SMEs to re-evaluate their risk management strategies.

In this context, prioritising improved safety measures reflects a proactive stance towards mitigating potential risks and disruptions, even at the expense of lower premiums. Moreover, GlobalData’s 2023 UK SME Insurance Survey found that medium-sized enterprises value risk management services more than their smaller counterparts when switching providers. 13.1% of medium companies stated that the main reason they switched was because of the new provider’s added risk management services. This compares with 11.1% of small enterprises, 5.1% of micro-enterprises, and 3.8% of sole traders.

Against this backdrop, the Flock-NIG partnership’s focus on driver safety should find a receptive target audience. Flock specialises in utilising advanced technologies and data analytics in motor fleet insurance. Through its platform, Flock leverages real-time data and artificial intelligence-driven algorithms to gather insights from connected devices, such as telematics systems. This data allows Flock to provide personalised risk assessments for motor fleets, tailoring insurance coverage based on factors such as driving habits, mileage, and road conditions. Flock has formed a partnership with NIG to target larger fleets in the commercial motor insurance market. The collaboration involves a digital, data-driven approach to motor fleet insurance, offering a fully digital insurance management portal, rebates for safer driving, and safety and claims workshops. Flock will leverage NIG’s capacity to provide real-time safety insights and interventions for fleet managers. The partnership aims to bring a fresh, data-driven perspective to the motor fleet market, particularly focusing on safety and risk management. Overall, larger businesses prioritise enhanced safety features, indicating a strategic commitment to proactive risk management. Insurers can benefit by providing customised solutions that prioritise safety, utilise data-driven insights, and foster collaborative risk management. Aligning with these safety preferences places insurers in a favourable position within the changing landscape of commercial motor insurance for larger businesses.