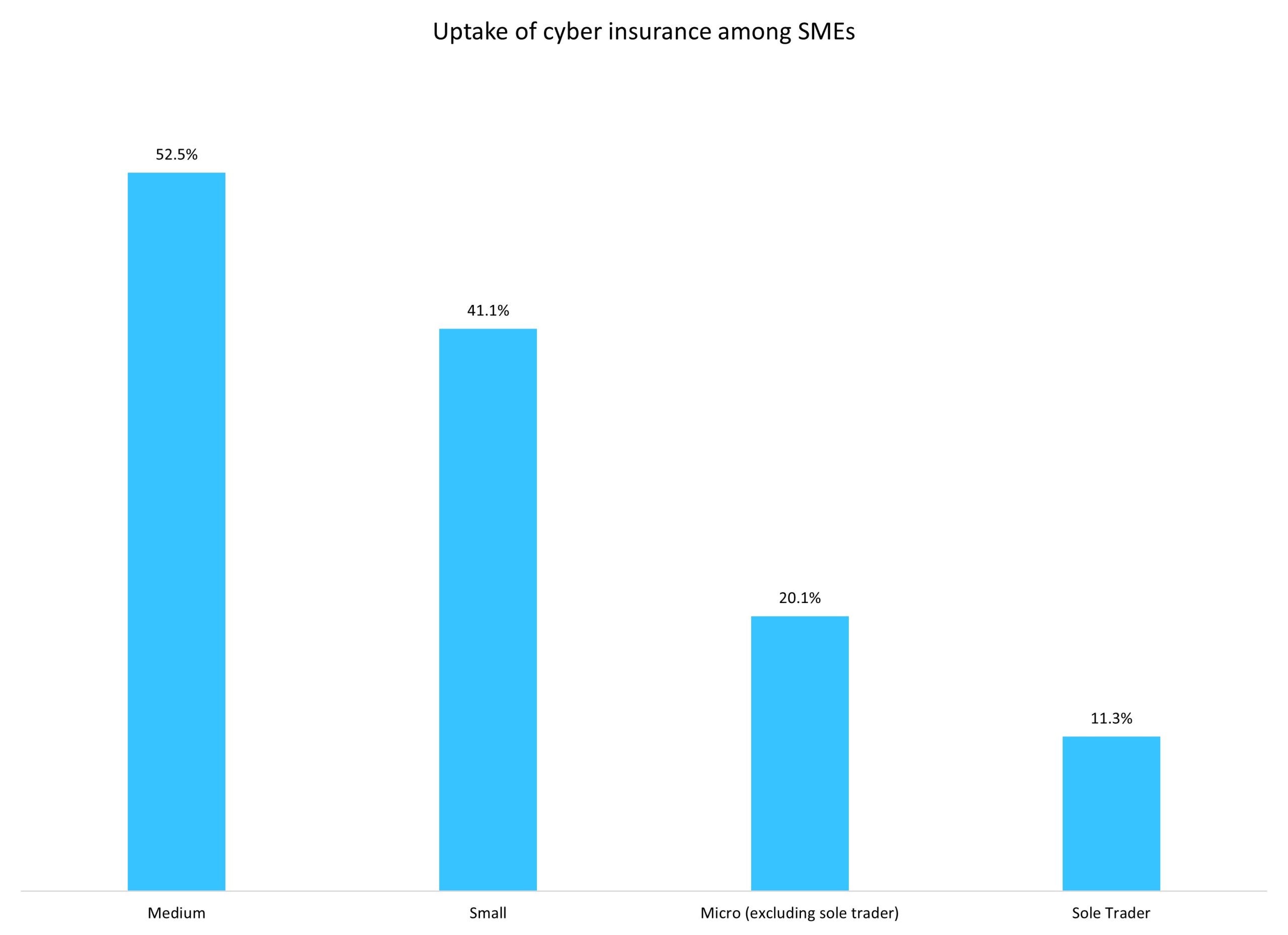

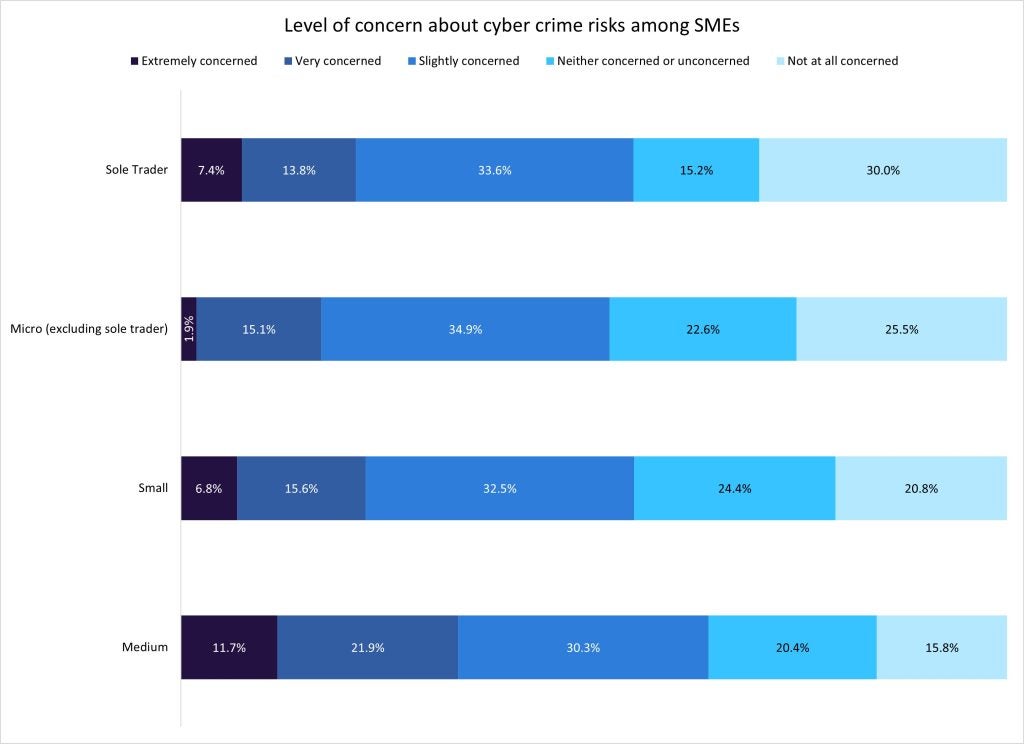

A disparity can be seen in the adoption of cyber insurance among SMEs. While medium-sized businesses boast a robust 52.5% uptake and small-sized businesses follow with 41.4% penetration, micro-enterprises and sole traders lag behind at just 20.1% and 11.3%, respectively. Yet it is evident that there is a strong need for cyber insurance, as concerns about cybercrime remain prevalent among SMEs of all sizes, with over 50% concerned to some degree.

With 63.9% of medium-sized businesses expressing some level of concern about cybercrime in 2023 (up from 62.7% in 2022), GlobalData’s survey emphasises the high level of worry among these businesses. This increased sense of concern is consistent with their higher adoption rates of cyber insurance, as medium companies are aware of the possible effects on their day-to-day operations. Yet it is interesting to note that even companies with lower cyber insurance adoption rates, like sole traders and micro businesses, still express a great deal of concern at 54.8% and 51.9%, respectively.

Businesses of all sizes are at risk from the evolving nature of cybercrime. As such, insurers should strive to offer coverage options that meet the needs of all types of businesses. Cowbell is an example of an insurer that has utilised its cyber offering to reach all sizes of the SME market; it is now expanding into the mid-market.

SMEs were also asked how cyber risk has changed compared to before the COVID-19 pandemic. GlobalData’s survey results show that perceived cyber risk for SMEs has increased, rising from 32.7% in 2022 to 34.3% in 2023. In response to this trend, 26.5% of SMEs said they would be more likely to buy coverage in 2023, up from 22.7% in 2022. The data indicates the growing desire for cyber insurance in the market—a trend that innovators like Cowbell are capitalizing on.

Having first focused on the SME sector, Cowbell has established itself as a progressive player in the cyber insurance space. As of January 2024, Cowbell is offering coverage to mid-market companies (those with an annual turnover of up to £1bn). With a large risk pool consisting of 4.5 million SMEs in the UK, its approach allows for data-driven evaluations of cyber risks. This information is then passed on to brokers to strengthen bonds and broaden their understanding of cyber risk, demonstrating a comprehensive approach to risk management.

Insurance companies must adjust their products to meet the needs of both small and large businesses in light of the cyber insurance gap. Despite their lower adoption rate, micro and sole traders continue to be concerned about cyber threats, which presents a sizable market opportunity. Insurance companies should also work with brokers to build partnerships and educate companies about how cyber risks are changing. Doing so will enable them to take advantage of the cyber insurance gap to improve their insurance books.