Consumers around the world are feeling the financial pinch brought about by stubbornly high inflation. As a result, they are now more likely to split the cost of their insurance into instalments, according to a GlobalData survey. Meanwhile, many insurers charge more to customers who opt to pay monthly rather than in one lump sum payment, effectively penalising consumers who cannot pay upfront.

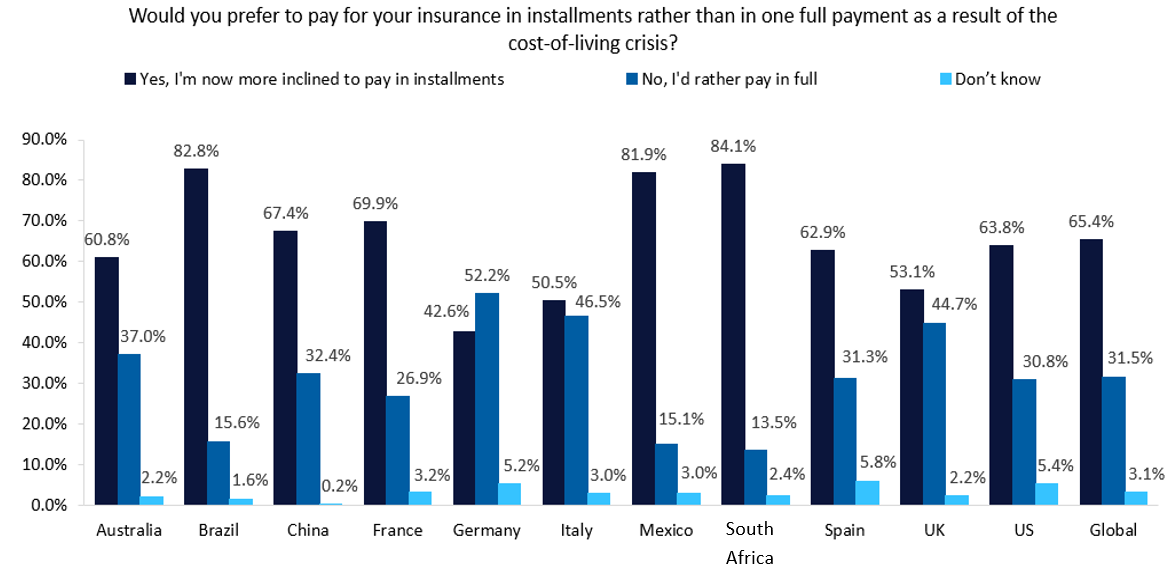

GlobalData’s 2024 Emerging Trends Insurance Consumer Survey found that 65.4% of global consumers prefer paying for their insurance in instalments because of the cost-of-living crisis. The survey, which was conducted in 11 key countries across different regions, revealed that the propensity of consumers to split the cost of their insurance bills over a period of time is particularly high in emerging nations. For instance, as many as eight in ten consumers in Brazil, Mexico, and South Africa would rather split the cost. Financial inequality in these countries is extremely high, explaining the large proportion of consumers leaning towards instalments.

It is not uncommon for insurers to charge interest on premiums to those consumers who want to pay their insurance bills in instalments. According to data released by Which? in September 2024, the average annual percentage rate (APR) charged in the UK for motor and home insurance policyholders paying in monthly instalments was 22.33% and 19.83%, respectively. Co-op Insurance was found to charge the highest APR, hitting 29.89% for both the motor and home lines. Insurers must understand that consumers are not necessarily paying their insurance in installments out of choice, but out of necessity. In fact, 14.6% of consumers around the world stated that they have fallen behind on their insurance payments in the last 12 months, as per GlobalData’s 2024 Emerging Trends Insurance Consumer Survey. While insurers may prefer the certainty of being paid in one go to minimise risk, the advantage of paying in instalments for consumers is eroded by adding a surcharge. This will essentially push consumers with healthier financials to forgo instalments while leaving those already struggling financially having to pay more for the same service.