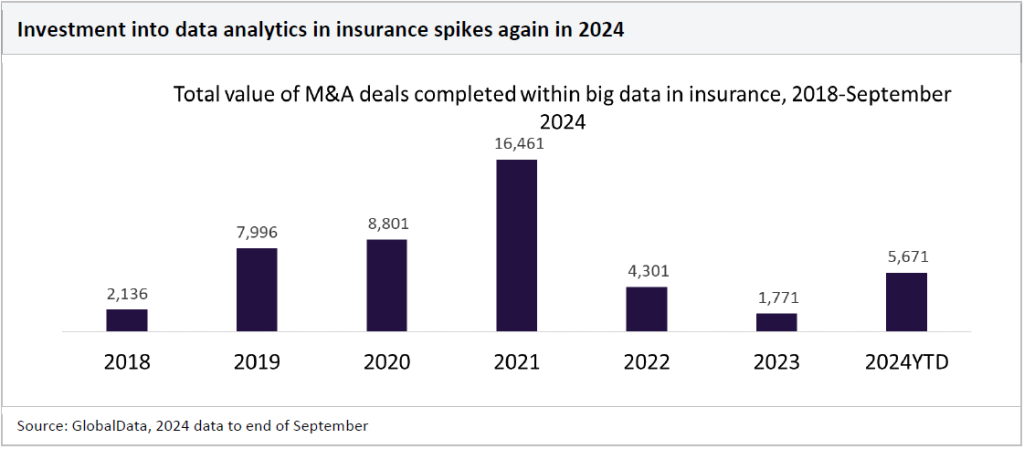

Investment in data analytics within the insurance industry during 2024 to the end of September has grown by 220% compared to the entirety of 2023, a new report has found.

According to GlobalData’s Data Analytics in Insurance report, sector M&A investment in the first nine months of this year stood at $5.7bn compared to $1.8bn for all of last year.

Noting two years of “extremely low” investment in 2022 and 2023, it characterises the performance for 2024 so far as “quite an extraordinary turnaround”, suggesting that this is indicative of renewed excitement for data analytics in the sector coupled with “lowly improving global macroeconomic and investment environments.”

The report points to the surge in interest in artificial intelligence (AI) as a likely driver of that excitement. GlobalData figures show that the AI market grew in value from $81bn in 2022 to $103bn in 2023 – a rise of over 27%, with a greater still compound annual rate of 39% forecast between 2023 and 2030.

Of the relevance of AI, the report explains: “Data analytics is central to the rise of both AI and personalisation within insurance. The strength of data is what allows AI to run smoothly and aids insurers in creating customer insights and providing personalised policies.”

It adds: “Data analytics is very much a facilitator to the rise of AI, and AI relies heavily on data to create outcomes. It combines strongly with data analytics as it allows insurers to collect, manage and analyse vast sums of customer data that would otherwise be too time-consuming.”

Among the other areas in which AI can be transformative for the insurance sector are improving underwriting processes, claims management, customer service and future trends prediction.

The levels of data analytics M&A investment within insurance in 2022 ($4.3bn) and 2023 ($1.8bn) were notable due to what had come before. Investment rose from £2.1bn in 2018 to $8bn in 2019 and £8.8bn in 2020 before peaking at $16.5bn in 2021.

GlobalData suggests the slump after 2021 was likely due to the challenging macroeconomic environment around the world, with the cost-of-living crisis, high inflation rates and high energy creating a difficult investing environment. It also notes that insurers “may have also been getting better at creating their own in-house data teams”, which could partly explain the drop-off.

Despite these factors, the report states that data analytics remains a key theme in the insurance industry, and it suggests that continued investment in the future will drive a range of innovation within the sector in the near future.