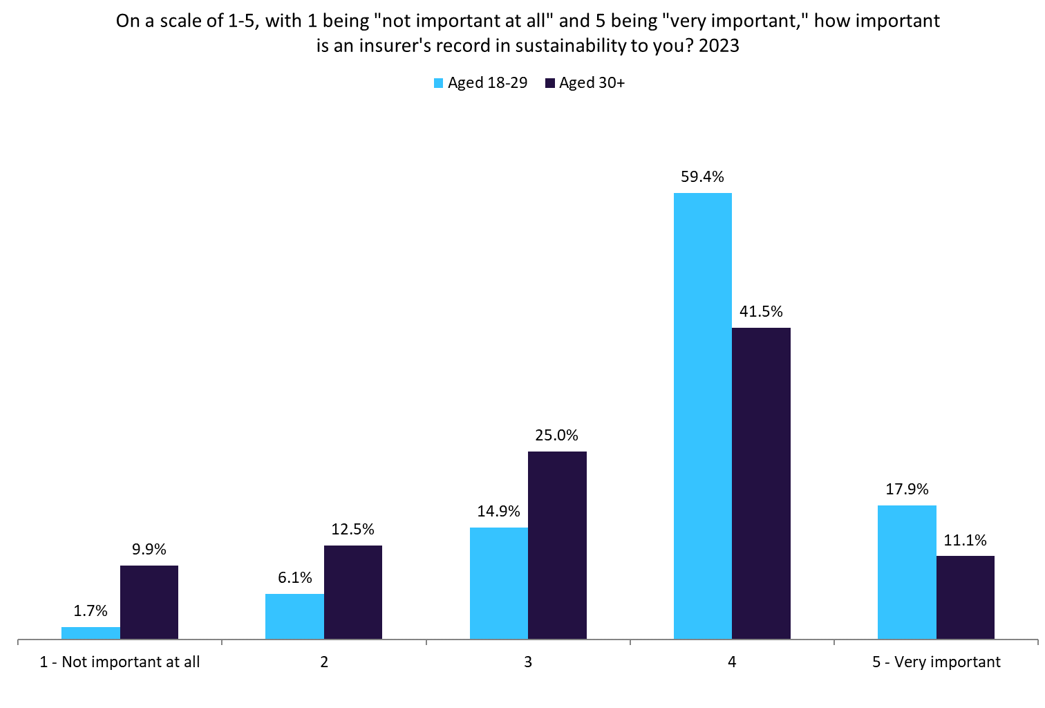

A study by Aviva reveals that consumers older than 65 are more inclined to adopt eco-friendly habits compared to other age groups. On the other hand, a survey from GlobalData shows that younger consumers place greater importance on an insurer’s record on sustainability than their older counterparts.

According to GlobalData’s 2023 UK Insurance Consumer Survey, consumers aged 18–29 prioritise insurers’ sustainability records more than older age groups. Specifically, 17.9% of those aged 18–29 consider sustainability to be very important, compared to only 11.1% of consumers aged 30 and above. Additionally, just 1.7% of consumers aged 18–29 view this issue as unimportant, compared to 9.9% of individuals aged 30 and above.

Meanwhile, a study from Aviva, supporting its latest Climate-Ready Index, reveals that individuals aged 65 and above are the most committed to eco-friendly practices. Specifically, 90% of over-65s turn off lights in unused rooms, 89% recycle as much as possible, and 76% lower their heating to conserve energy. Additionally, 72% use low-temperature or short cycles on their washing machines, 56% avoid items with excessive packaging, 53% prefer to buy locally sourced food where possible, and 50% opt to repair rather than replace items. In contrast, those aged 18–24 show the lowest participation in each of these actions compared to other age groups, highlighting a generational gap in climate-conscious behaviours. So while younger consumers are less likely to engage in everyday eco-conscious behaviours, they express stronger concerns about the sustainability credentials of companies they choose to support, including insurers. This discrepancy might stem from younger generations’ broader exposure to climate-related issues via digital media, coupled with a heightened awareness of corporate responsibility. For these younger individuals, choosing sustainable brands is a form of advocacy. They see corporate environmental commitments as crucial, as they believe larger-scale change depends on institutional accountability. This could explain why, even if their daily behaviours may not reflect intense environmental action, their consumer choices lean heavily towards brands that demonstrate sustainable practices.

For insurers, this generational insight suggests an opportunity to align their practices and messaging to appeal to both younger and older customers. Insurers could benefit from highlighting tangible environmental actions—such as reducing paper waste, optimising energy use in offices, or supporting renewable energy projects—as these efforts might resonate with older customers who already value personal eco-friendly habits. At the same time, they should clearly communicate a commitment to sustainability through transparent reporting and sustainability initiatives to appeal to younger consumers who prioritise corporate responsibility.