President-elect Donald Trump has largely positioned himself as an opponent of environmental, social, and governance (ESG) mandates, portraying them as burdensome to businesses and harmful to economic growth. However, a GlobalData survey shows that US consumers place significant importance on the environmental practices of insurers, indicating that insurers still need to engage in ESG efforts despite potentially reduced pressure from the government.

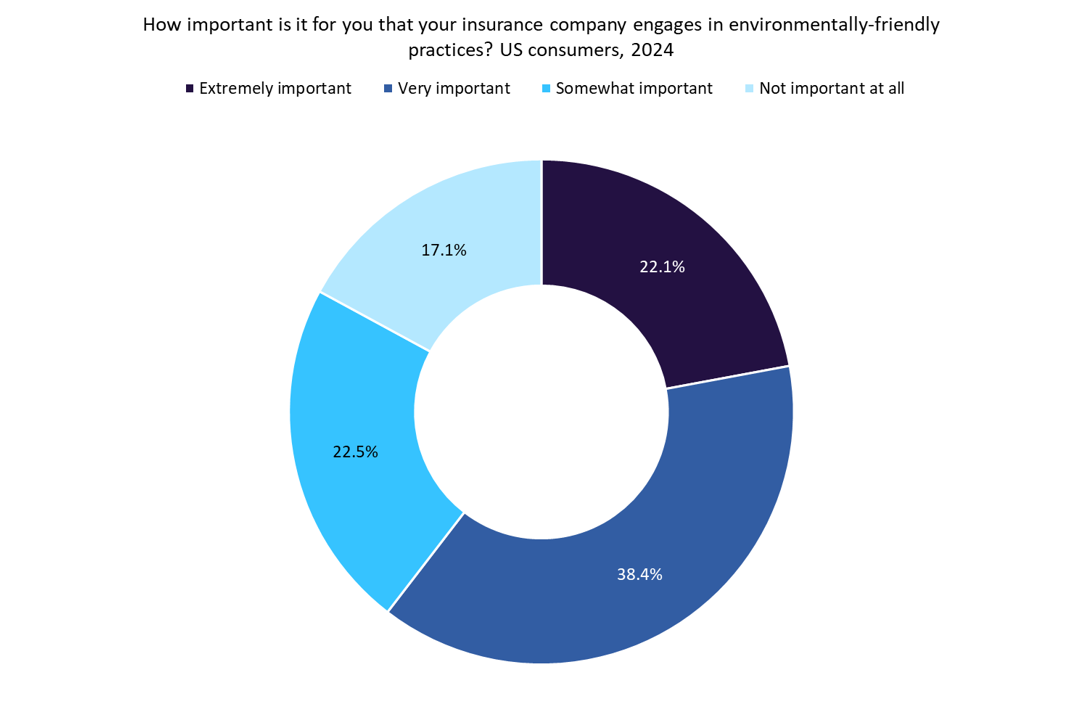

According to GlobalData’s 2024 Emerging Trends Insurance Consumer Survey, 38.4% of US consumers consider it very important for their insurer to engage in environmentally friendly practices while 22.1% view it as extremely important. Additionally, 22.5% see it as somewhat important while just 17.1% say it is not important at all.

Meanwhile, Trump has previously claimed that ESG policies often prioritise political agendas over profit and efficiency, which he believes should be the focus for US companies. During his election campaign, he criticised ESG-driven regulations and suggested that they can stifle innovation and limit the ability of US businesses to compete on a global scale.

Trump’s win is expected to have a substantial impact on the future of ESG in the US. Under his administration, there may be a rollback of regulations that enforce ESG principles, particularly those tied to environmental protections and corporate disclosures of social and governance practices. His focus is likely to shift toward promoting traditional energy sectors such as oil and gas, supporting deregulation, and reducing federal oversight on companies’ environmental and social practices. This approach could ease operational constraints for some businesses, but it may also lead to a reduced emphasis on climate goals, potentially creating friction with stakeholders who see ESG as essential for long-term resilience and responsibility.

Nonetheless, insurers should still commit to ESG practices, as doing so can significantly enhance brand image and foster customer loyalty. With a large portion of consumers prioritising environmental responsibility, insurers that actively engage in sustainable practices demonstrate alignment with customer values, helping to build trust and strengthen relationships. Globally, the trend is shifting toward green and renewable energy, with insurers increasingly reducing their engagement with carbon-intensive industries. As part of this broader movement, US insurers will likely be expected to adopt net-zero strategies, reduce involvement with carbon-heavy sectors, and lead in supporting a sustainable economy.

By showcasing their commitment to ESG, insurers can differentiate themselves in a competitive market, positioning their brand as socially responsible and future-focused. This emphasis on sustainability will not only attract and retain environmentally conscious customers but also contribute to long-term loyalty and a positive brand reputation.