Decumulation has brought high growth and high returns to many UK life insurers. Waheeda Narker, retirement & decumulation segment lead, insurance consulting and technology at WTW, explores the sustainability of this recent trend.

A number of factors are likely to determine future supply and demand of the decumulation market, as well as the industry’s capacity to continue to secure the retirement income of millions of pensioners. These are retail trends, institutional and regulatory drivers, pricing and investment issues, supply and demand.

Retail trends

After a period in which annuities have been expensive due to low interest rates and challenging investment conditions, we are starting to see a resurgence in annuity values and consumer interest. We put this down to higher interest rates, an enhanced focus on security in the wake of the COVID-19 pandemic, and heightened recognition of later-life care needs.

For example, our benchmark for the annual value of a single life, level and no guarantee period annuity for a 65-year-old man with a £100,000 fund stood at £6,283 in August 2022. This compared to £4,696 in August 2016, an increase of about 15% after allowing for inflation.

Will such increases be enough to stimulate annuity sales after a period in the doldrums? Possibly, but there are also things that insurers, to some extent backed by governments that want to encourage higher levels of retirement saving, can do to make them more attractive.

One, already common in the UK, is offering the flexibility to allow drawdown in earlier retirement years but, importantly and less commonly, in combination with a facility to allow undrawn funds to continue to attract investment income. Another change in practice that could be beneficial is including inflation protection in quotes as standard, along with an explanation of how this helps the annuitant. This could help counter the historically low take-up of inflation protection and the negative outcomes and perceptions this can lead to.

New services that life insurers could usefully consider to increase attractiveness, in our opinion, include the provision of periodic general practitioner visits and access to wellness and exercise activities. This would also have the effect of promoting ‘prevention as a cure’, thereby also helping to reduce strains on the National Health Service.

Longevity pooling

Another potential market stimulant is longevity pooling, which is already well established in markets such as the U.S. and Australia and is starting to gain traction in the UK as a potential retail decumulation option that appeals to some pensioners.

Of course, pooling of risk is hardly new to insurers. The difference here is that members pool their retirement funds and, for insurers, it can offer a way to spread longevity risk.

Although there is no guaranteed income, each year the pool members receive payments based on their probability of surviving. Further benefits of pooling are that members enjoy investment returns and, in effect, they gain mortality credits from members who die. Moreover, after 10 to 15 years, surviving members also receive a regular annuity based on accumulated funds to avoid the tontine effect – where a large windfall would go to the last survivor.

Institutional and regulatory drivers

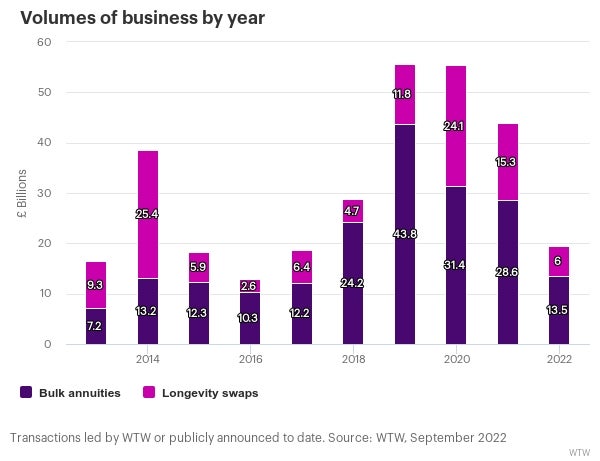

Turning to pension risk transfer, or bulk annuities as they’re known in the UK, 2022 was another strong year. In late August, Legal and General’s Pension Risk Transfer Monitor1 reported an estimated £12bn worth of transactions took place in the first half of the year, an increase of around 50% on the same period in 2021. At the time, it forecast the overall volume in 2022 would be between £30-35bn, which would be the second largest ever in a year in the UK.

However, there are over £2trn of defined benefit pension liabilities that could be transferred to insurers over the next 20 years. Demand from pension funds exceeds supply. The question is whether insurers are able to step up to meet the demand.

With a core of active market participants in the UK, the availability of capital is not the issue. Potential deterrents historically, however, have been the regulatory regime, the high market entry barriers, the limited credit asset universe and the time and bandwidth needed to get deals done.

Solvency II reforms

Elements of the proposed Solvency II reforms in Autumn 2021 would have added to this list of possible deterrents – a reason we have been working closely with the Association of British Insurers to identify and quantify the likely impacts.

We welcomed the latest Consultation response from HM Treasury which “drops” the most onerous elements of the proposed reforms. With particular reference to annuity writers, the most relevant changes were:

- Recalibration of the risk margin leading to a 65% reduction.

- Unchanged fundamental spread calibration but with increased risk sensitivity via the introduction of notching within rating categories.

- Increased supervisory oversight related to stress testing and attestation of adequacy of the fundamental spread by a nominated Senior Management Function (with potential for add-ons).

- Broader scope of MA eligibility, including assets with prepayment risk or construction phases and the removal of severe treatment of sub-investment grade assets (ratings lower than BBB).

- Removal of the requirement that all assets have fixed cashflows and including assets with highly predictable cashflows, therefore reducing cost of restructuring and securitisation.

While the devil is in the detail, we think overall that these changes, in particular the reduction in the risk margin, will increase capacity for insurers. They may well reinsure less longevity risk and so reduce the cost of reinsurance or, if longevity reinsurance remains competitive, continue to reinsure similar proportions to reduce the solvency capital (also improving capacity).

Widening the universe of assets with highly predictable cashflows may help match longer-duration liabilities, especially given the increase in demand for full scheme liability buy-outs including deferred pensioners. On asset eligibility it may be the case that private assets held by some pension schemes may be more palatable as an in-specie transfer on buy-out which may be attractive to all parties.

So we remain positive that 2023 and beyond will continue to see high volumes of bulk annuity activity including new entrants into the UK market.

Pricing and investment issues

One thing we have observed since the COVID-19 pandemic struck is some diverging industry views on longevity. The reason the different interpretations of the data between insurers, reinsurers and pension scheme actuaries matter is that they can lead to price dislocation and bulk annuity trading inefficiencies, including, in some cases, risk transfer deals not going through. So, it seems it would be in all market participants’ interests to discuss any potential disparities in longevity assumptions early on in a process.

On investments, I alluded earlier to the finite nature of the corporate bond and private credit asset markets. Demand from insurers and other institutional investors outstrips supply in the U.S., Canada and the UK, reducing returns as a result. Possible solutions that we are discussing with clients include considering smaller issuances for better risk/return characteristics and investing in a wider range of alternative credit assets.

Supply and demand

Our UK pensions team that helps broker bulk annuity purchases has highlighted various issues associated with supply and demand in the current decumulation market.

Prominent among them is that many smaller schemes find themselves in a position where insurers are refusing to provide quotes, or will only do so if they have exclusivity. At the other end of the scale, the team reports that while affordability for larger schemes has improved, it takes a long time to execute deals. Moreover, the execution price may be unclear until they go to market, sometimes causing trustees to pull back from deals.

A lingering issue across all parts of the market is data quality – many pension schemes don’t meet the standards insurers would like. A typical consequence is that insurers won’t accept all-risks policies, meaning that the pension scheme has to retain some of the basis risk. This can be a barrier to deal execution.

Expanding capacity?

Maybe it’s time for the industry to consider an ecosystem whereby insurers work together to streamline the deal execution process – that is if it wants to grow the market beyond the current £30bn to (say) £50bn.

Today’s multiple round tender processes are extremely resource intensive and time consuming. One potential approach could be a bureau that identifies schemes close to execution and enables insurers to work with pension schemes to:

• Help with investment strategy, such as identifying illiquid assets that are MA compliant.

• Use standardised cashflows (can be bespoke for actual deal) to provide schemes with pricing on a consistent basis and aid de-risking timing. This, in turn, would increase deal execution certainty.

• Develop an all-risks policy so basis risk is insured.

• Streamline advisor time and align insurer, reinsurer and pension scheme actuary views on longevity and pricing.

Most market players are confident that market demand for retail and institutional decumulation products can only increase. This may sound like good news for all, but of course no insurer can take their own future success for granted. 2023 will be a very interesting year.