Amazon Insurance Store, which offered a range of home and contents policies, has already closed its doors having only launched as recently as October 2022. GlobalData surveying suggests that the limited availability of products and providers on the platform could be a contributing factor to the store’s lack of success.

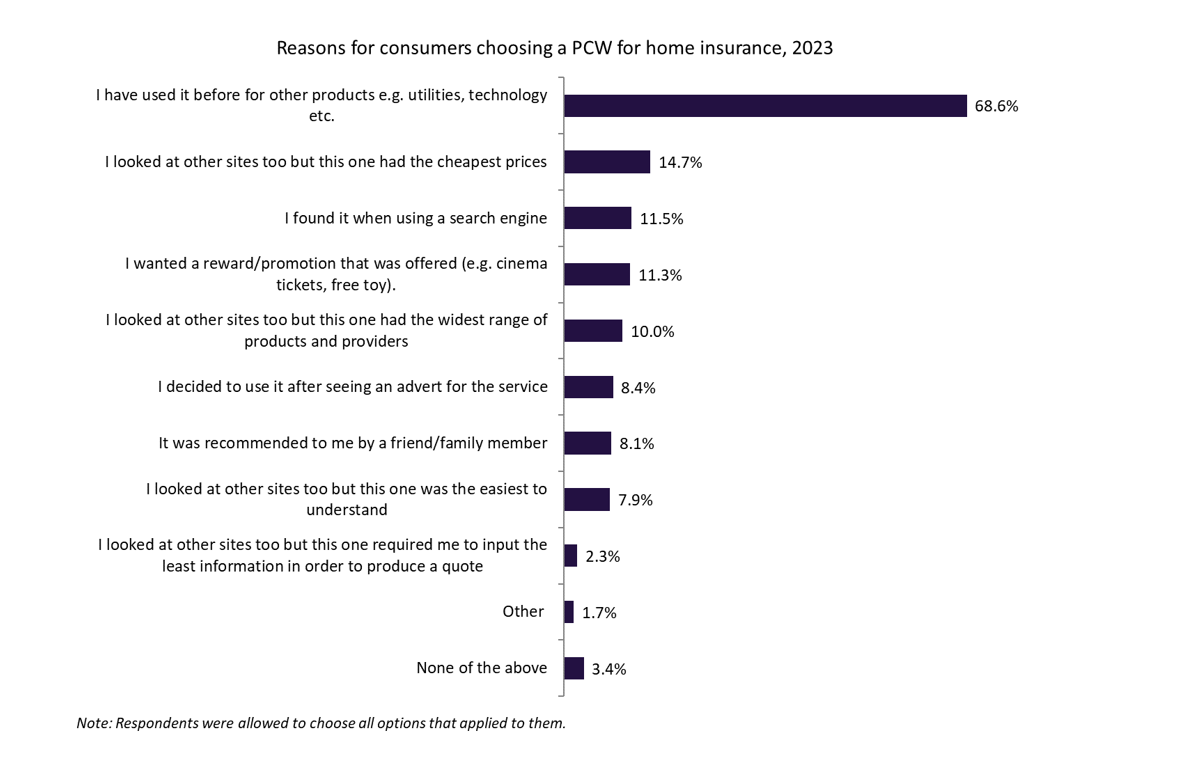

According to the 2023 UK Insurance Consumer Survey by GlobalData, 68.6% of respondents selected a particular price comparison website (PCW) based on prior usage. This trend posed a challenge for the relatively new Amazon Insurance Store, launched just 15 months ago, as it lacked an established user base. Likewise, 10.0% of survey participants chose a specific PCW due to its extensive range of products and providers. Despite Amazon Insurance Store offering home and contents policies, the absence of other essential products such as car or travel insurance may have limited its appeal. Moreover, with only a few providers on the platform, including Ageas UK, Co-op, LV=, Policy Expert, and Urban Jungle, Amazon’s offering fell short in terms of the diverse range of providers that consumers typically seek on established PCWs. This limited selection might have contributed to the challenges faced by Amazon Insurance Store in gaining traction among consumers.

Despite Amazon’s global reputation and brand recognition, entering the insurance PCW market is a challenging task. GlobalData’s 2023 UK Insurance Consumer Survey indicates that 95.6% of consumers who utilized a PCW to purchase their home insurance policy opted for either CompareTheMarket (47.9%), Moneysupermarket (19.0%), Go.Compare (14.6%), or Confused.com (14.0%). This dominant market share held by established players presents a barrier for new entrants. A case in point is the closure of the reverse auction marketplace Honcho in July 2022, which found the competition with leading PCWs to be too great a hurdle. Interestingly, Amazon’s venture into the UK insurance PCW market lasted around the same length of time as the Google Comparison project, an aggregator launched by the search engine in 2012. This further highlights the persistent challenges faced by tech giants in establishing a foothold in this highly competitive landscape. Even with Amazon’s extensive reach and recognition, the challenge of displacing the well-established players in the insurance PCW landscape remains a significant hurdle.

Overall, Amazon’s struggle to gain significant traction may be attributed to factors such as limited product offerings, a lack of user familiarity, and a relatively small number of providers on its platform. Despite Amazon’s global reputation, the platform failed to compete against established players such as CompareTheMarket, MoneySuperMarket, Go.Compare, and Confused.com that continue to dominate the market.Top of Form

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData