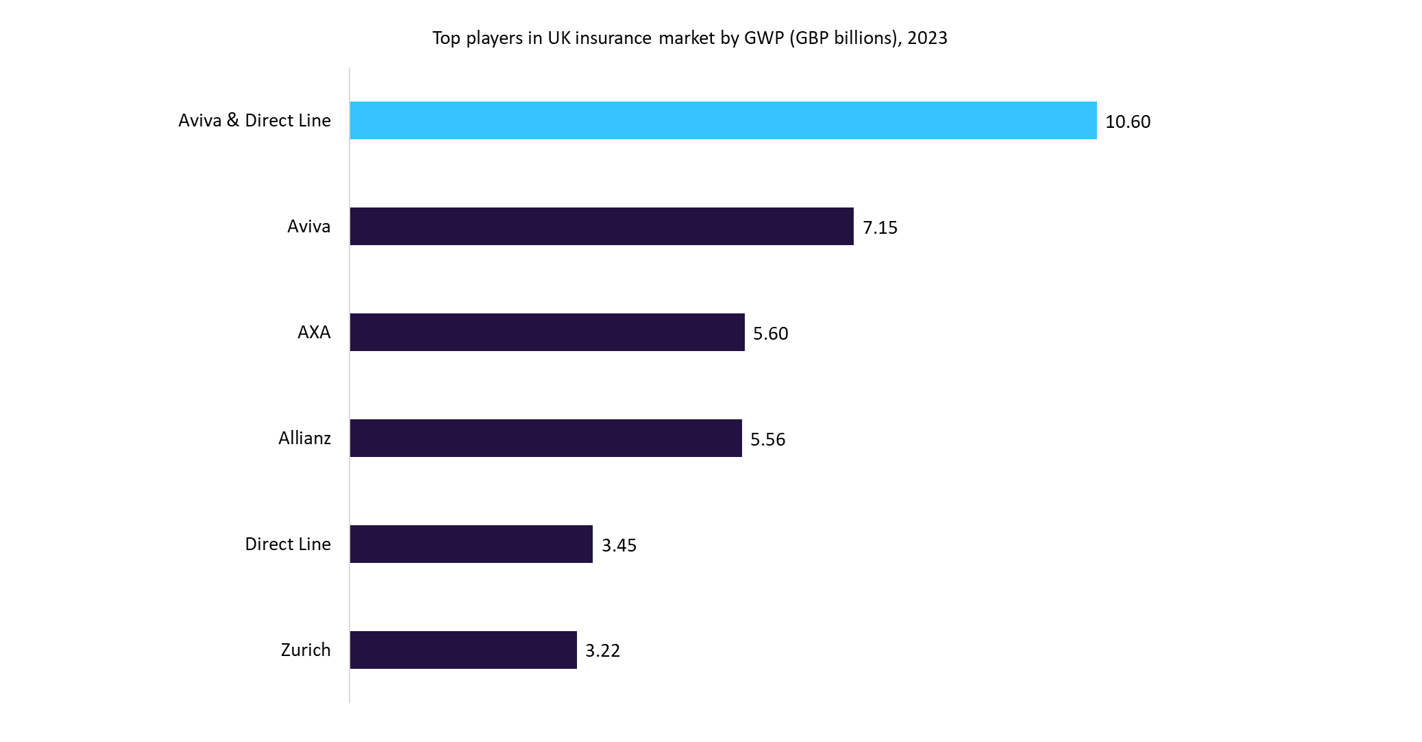

Aviva has agreed to a £3.6bn takeover deal with Direct Line after recently improving its offer. Meanwhile, GlobalData findings show that Aviva’s acquisition of Direct Line would help the insurer extend its lead as the dominant player in the UK insurance market. GlobalData’s UK Top 25 General Insurance Competitor Analytics reveals that Aviva’s acquisition of Direct Line would significantly strengthen its dominance in the UK insurance market. In 2023, Aviva reported gross written premiums (GWP) of £7.15bn, 27.9% higher than second-placed AXA. By adding Direct Line, a top-five competitor in its own right, Aviva’s lead would widen substantially. Together, Aviva and Direct Line recorded a combined GWP of £10.60bn in 2023—an 89.5% increase over AXA. This share would account for 14.4% of the UK insurance market.

The acquisition would also amplify Aviva’s position in specific insurance lines such as home and motor. In the home insurance market, Aviva is already the leader with a GWP of £1.32bn in 2023, while Direct Line ranks fifth with £531.7m. Combining these figures would further solidify Aviva’s strong position in this segment. In the private motor insurance market, Aviva currently holds second place, with Admiral leading with GWP of £2.48bn in 2023. However, when combining Aviva’s GWP of £1.62bn and Direct Line’s £1.53bn, Aviva would surpass Admiral, securing the lead with GWP of £3.15bn. Aviva’s proposed £3.6bn acquisition of Direct Line would represent a major consolidation in the UK insurance market, positioning Aviva as the leading player across key segments such as motor and home insurance. The deal, which offers Direct Line shareholders 129.7 pence in cash and 0.2867 new Aviva shares per share—bringing the total valuation to 275 pence—also includes a 5 pence dividend. Post-acquisition, Direct Line shareholders are expected to own approximately 12.5% of the combined entity.

In an environment characterised by rising claims costs, inflationary pressures, and increasing competition, larger insurers benefit from economies of scale, operational efficiencies, and enhanced bargaining power with suppliers. Aviva’s acquisition of Direct Line would enable cost savings through streamlined operations, improved digital capabilities, and a broader customer base. These efficiencies could potentially translate into competitive pricing and better service offerings for policyholders. However, the long-term impact on consumers is less certain. In the motor insurance market, where Aviva and Direct Line currently hold significant shares, their combined position would overtake existing leader Admiral. Similarly, in the home insurance market, Aviva’s already dominant position would be further strengthened if Direct Line adds to its market share. While operational efficiencies might drive down costs for Aviva, the reduced number of major competitors could limit consumer choice.