A significant proportion of global consumers would be happy for an artificial intelligence (AI) tool to determine the outcome of their claim, according to a GlobalData survey. As AI adoption continues to gain traction, insurers must make sure their solutions are able to deliver on the customer experience as tolerance for failure will be limited.

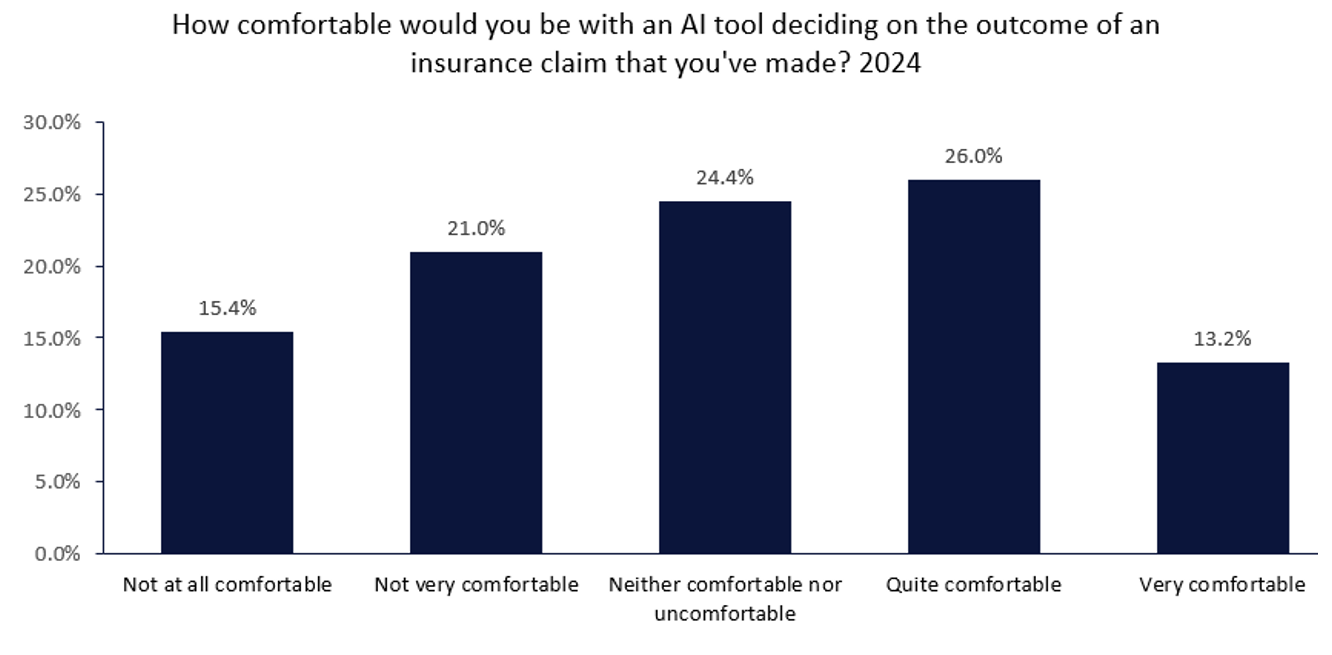

GlobalData’s 2024 Emerging Trends Insurance Consumer Survey found that 39.2% of consumers around the world would be comfortable or very comfortable with an AI tool to decide the outcome of an insurance claim they have made. This is higher than the proportion (36.4%) who would not be happy with the idea. Making a claim is often one of the most stressful points at which policyholders interact with insurers, if not the most stressful time. With this in mind, insurers must ensure the seamless integration of AI in claims management from the outset, or risk discouraging consumers from embracing automated tools.

Claims processing is one of the areas in the insurance value chain ripe for automation, particularly concerning more straightforward claims. While most insurers have started taking steps to integrate AI solutions in the value chain, insurtech DGTAL has gone a step further, developing completely autonomous AI agents. Reportedly, it is the first insurance-focused AI company to use AI agents as a core element of its claims platform DRILLER. Traditional AI solutions are programmed to provide a single response to a prompt, while according to DGTAL, its AI agents can operate real workflows and work together with other AI agents or human experts. They have also been equipped with their own personalities. Insurers can accelerate claims processing with the use of AI solutions, as these can scan vast amounts of data faster and increase accuracy. Global consumers are already acknowledging the benefits of AI—indeed, the majority (71.2%) believe that AI can assess data and patterns more accurately and faster than humans as per further findings from GlobalData’s 2024 Emerging Trends Insurance Consumer Survey. An increase in the speed of claims processing, as well as the ability to liaise with an agent 24/7, will naturally be beneficial for customers. Yet as with any new technology, consumers’ tolerance for failure will be low and will lead to a negative perception of AI solutions, particularly as the loss of human touch is one of the main barriers for consumers when interacting with AI tools. As such, insurers must make sure that the rollout of their AI solutions, including AI-powered bots or digital avatars, is optimized to deliver the right experiences at the right time.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData