A GlobalData poll has revealed interest in insurance policies that cover the liabilities arising from dysfunctional AI outputs. Meanwhile, Orbital Witness and First Title Insurance have launched an insurance policy covering the accuracy of Orbital’s generative AI outputs.

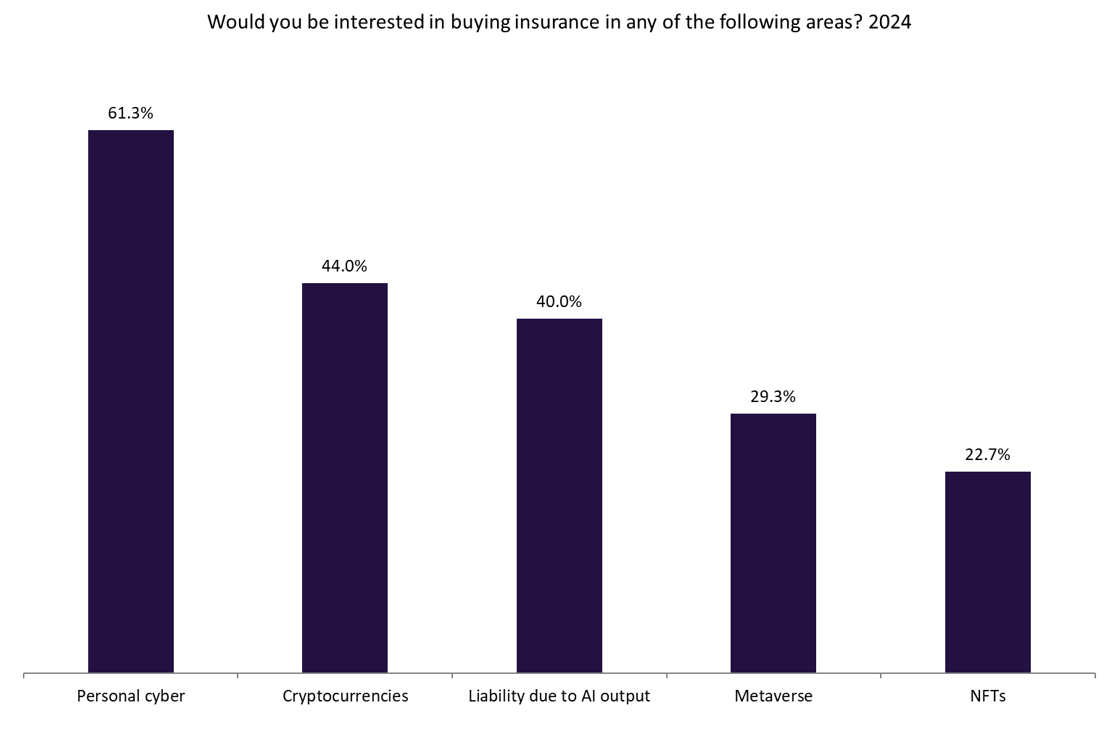

In Q1 and Q2 2024, GlobalData asked readers of Life Insurance International whether they would potentially be interested in buying insurance across various areas. They selected personal cyber as the leading product (61.3%) while liability due to dysfunctional AI output was cited by 40% of respondents. As AI systems become more prevalent, the potential for errors and unintended consequences increases, leading to demand for insurance products that can provide a safety net against these risks.

Against this backdrop, Orbital Witness and First Title Insurance have launched an insurance policy covering the accuracy of generative AI outputs. This innovative product, a first in the legal tech sector, offers protection against errors in AI-driven processes, particularly for real estate transactions. Under the partnership, First Title will underwrite Orbital Witness’s generative AI product output, covering errors that result in compensation claims. Initially, AI Reliance policies will be available to law firm customers of Orbital Witness’s Orbital Residential product, without requiring them to claim on their professional indemnity insurance. Clients can add this coverage for a nominal fee, ensuring they are safeguarded against potential inaccuracies and their consequences. This initiative aims to provide legal professionals with enhanced security and confidence in using AI tools, marking a significant advancement in integrating AI within the legal industry.

Inaccurate AI outputs can have severe consequences for businesses. Financially, they can lead to significant monetary losses if AI-driven models or recommendations are flawed. Incorrect AI outputs, especially in legal contexts, can result in lawsuits and regulatory penalties. Moreover, errors caused by AI can damage a company’s reputation, reducing customer trust and loyalty. Operationally, faulty AI decisions can disrupt business processes, causing delays and inefficiencies.

Additionally, security risks can arise if AI systems misjudge threats, leaving businesses vulnerable to cyberattacks. Therefore, insurance policies that cover inaccuracies in AI outputs such as the one from Orbital Witness and First Title Insurance, are crucial to mitigate these risks. The insurance industry is witnessing a shift in focus, with emerging technologies driving new types of insurance needs. Policies that cover AI-related liabilities are poised to become a crucial component of risk management strategies for businesses that leverage AI. Insurers have the opportunity to develop innovative products that not only address these risks but also educate their clients on best practices for AI implementation and risk mitigation.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData