Consumers are turning to price comparison websites (PCWs) as a key channel for researching and purchasing insurance products, given that consumers are looking for value amid the cost-of-living crisis. This highlights the importance for insurers to establish a presence on these platforms to increase visibility and accessibility to potential customers. Founded in 1985, Direct Line—which as the name suggests, previously focused on selling direct to customers—has changed its stance and made the strategic decision to utilize these platforms to enhance its distribution channels.

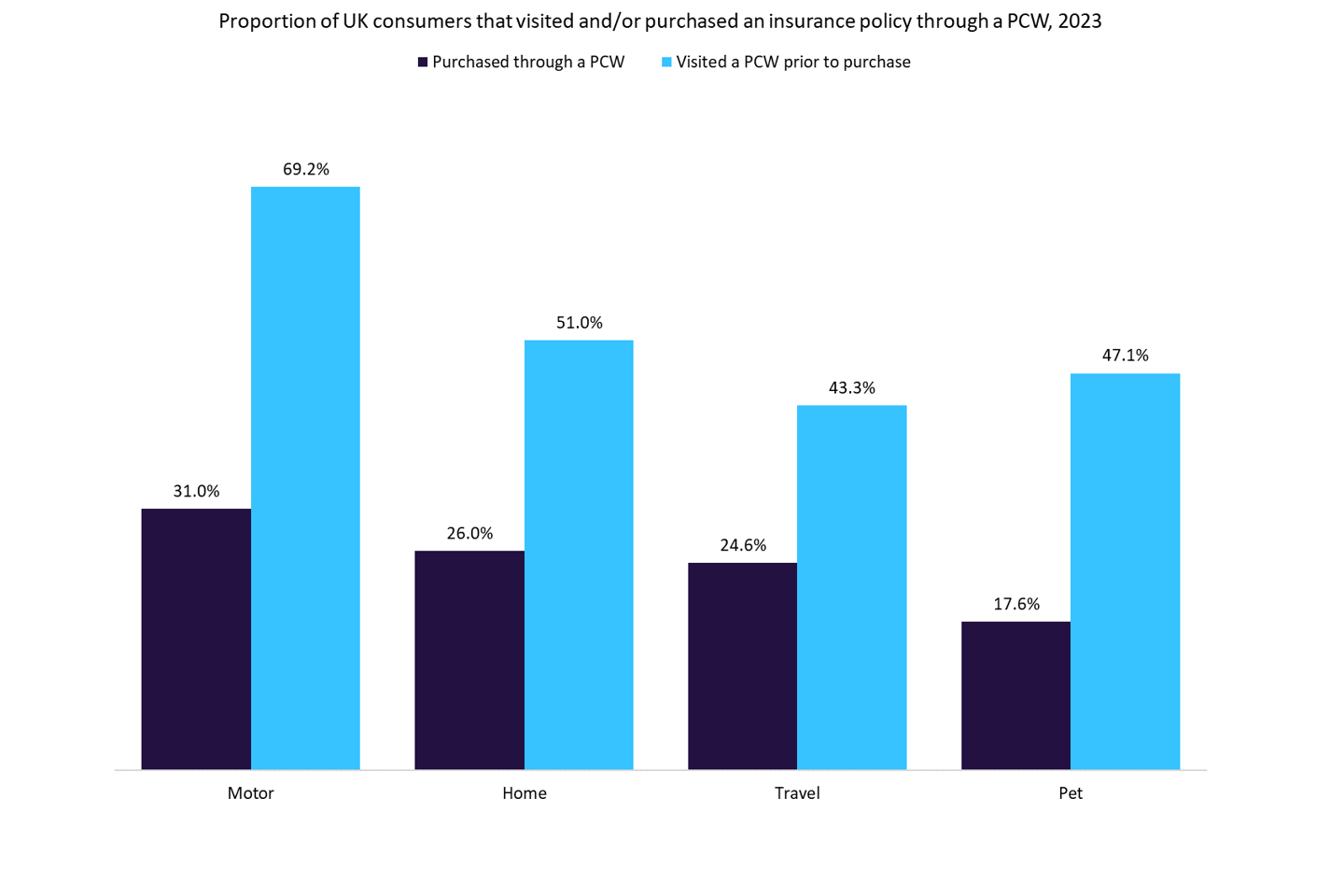

GlobalData’s 2023 UK Insurance Consumer Survey reveals that a substantial portion of general insurance policies are sold through PCWs. For example, in 2023, 31% of motor, 26% of home, 17.6% of pet, and 24.6% of travel insurance policyholders bought their coverage through PCWs. Additionally, a large proportion of insurance policyholders in these categories actively used PCWs as part of their decision-making process before making a final purchase. This highlights the critical role that these platforms play in the consumer journey and underscores the importance for insurers to have a presence on these websites to effectively reach and expand their customer base.

Direct Line’s decision to move away from solely selling direct by launching a motor product on PCWs signifies a strategic shift aimed at reaching a broader audience of potential customers, especially those who are looking for value given the current cost-of-living crisis. This move follows Direct Line research noting that 90% of consumers turn to PCWs when making insurance decisions. Moreover, Direct Line has shifted its focus toward key lines of business, such as home and motor insurance, while stepping back from other areas like pet and travel insurance. This strategic move will enable Direct Line to enhance its position in the motor insurance market by utilizing PCWs.

While a large portion of policyholders visit PCWs before making a purchase, the conversion rate to actual sales through PCWs remains comparatively low. To improve this conversion rate, PCWs could consider implementing features such as personalized recommendations based on user preferences, offering exclusive deals or discounts only available through the platform, providing a seamless and user-friendly interface for easy navigation, and enhancing customer support services to address any queries or concerns promptly. By enhancing the overall customer experience and value proposition, PCWs can better convert potential customers into actual sales. In light of the cost-of-living crisis, whereby more individuals are looking for value in their policies, insurers should recognize the advantages of utilising PCWs. Direct Line’s decision highlights the increasing importance of PCWs as an important channel for insurance purchases by consumers. PCWs can aid insurers in enhancing their visibility, attract new customers, and drive business growth, acting as a form of advertisement—potentially reducing the reliance on costly advertising campaigns and lowering overall expenses.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData