A GlobalData poll reveals that insurance industry insiders believe both home and motor insurance will experience the sharpest increases in premiums over the next year. While insurers are battling emerging risks and rising repair costs, the news will naturally leave a sour taste for consumers—who will have to pay more at renewal without necessarily understanding the industry’s challenges.

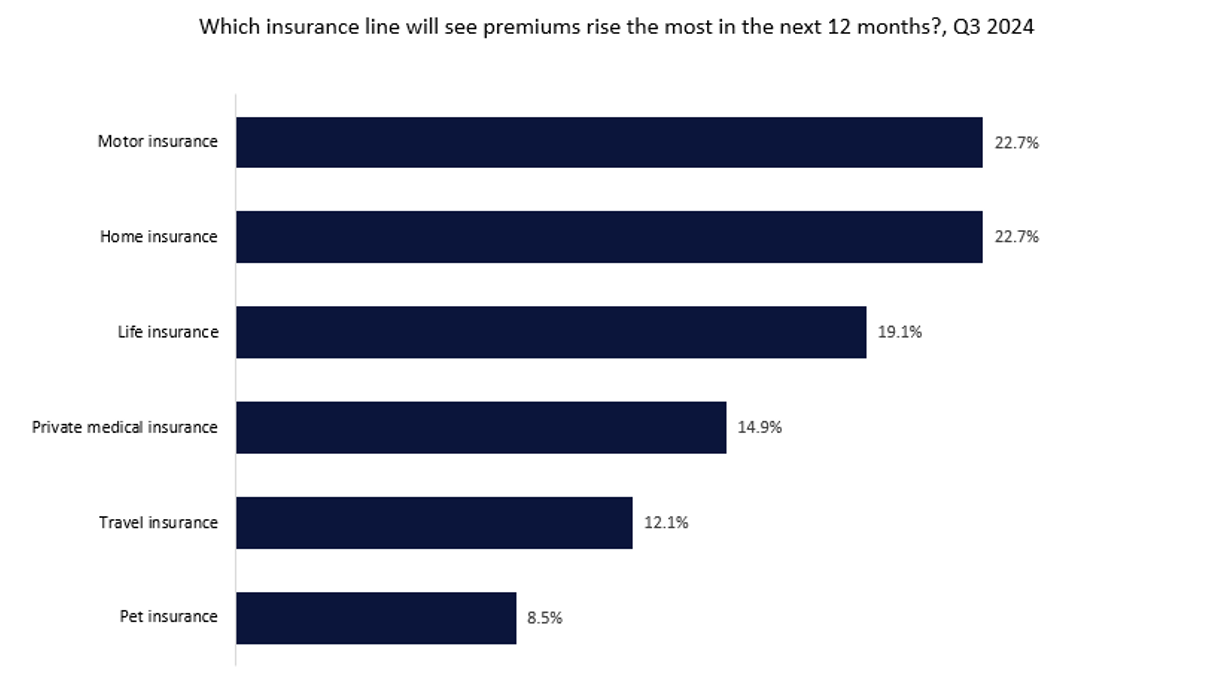

A GlobalData poll ran on Verdict Media sites in Q3 2024 found that home and motor insurance are viewed as the lines that will see premiums rise the most over the next 12 months, each attracting 22.7% of responses from insurance industry insiders. While the cost-of-living crisis has pushed prices up—with insurance being no exception—rising costs linked to home and motor insurance lines have split opinions on which premiums will fare worst.

Stubbornly high inflation remains a significant challenge to the industry; while it has the potential to affect all lines, home and motor insurance are among the most widespread personal lines. The costs associated with rebuilding a property—as well as the repair and replacement costs linked to vehicles—have mounted, yet insurers are also trying to grapple with emerging risks on both lines.

Climate change is increasing the frequency and severity of weather events and natural catastrophes. In the home line, insured losses from these events are becoming a real challenge, with insurers losing appetite to cover properties located in certain natural catastrophe-prone areas altogether. On top of that, rises in construction material prices and labour rates further aggravate claims, forcing rates up.

The situation with motor insurance is similar. The increasing amount of in-built vehicle technology is making repairs costlier. The proportion of more sophisticated vehicles on the road, such as electric models, is gradually increasing, and these demand specialist repair shops. Electric vehicles also change the nature of risks compared to petrol or diesel vehicles, with battery explosions now being a claim reason.

While consumers will likely have to pay more for their home or motor insurance, they will not understand the extent of the factors driving premiums up. The industry needs to build better awareness about the challenges it faces, or consumers will be left to believe that insurers are taking renewals as simply an opportunity to increase premiums.