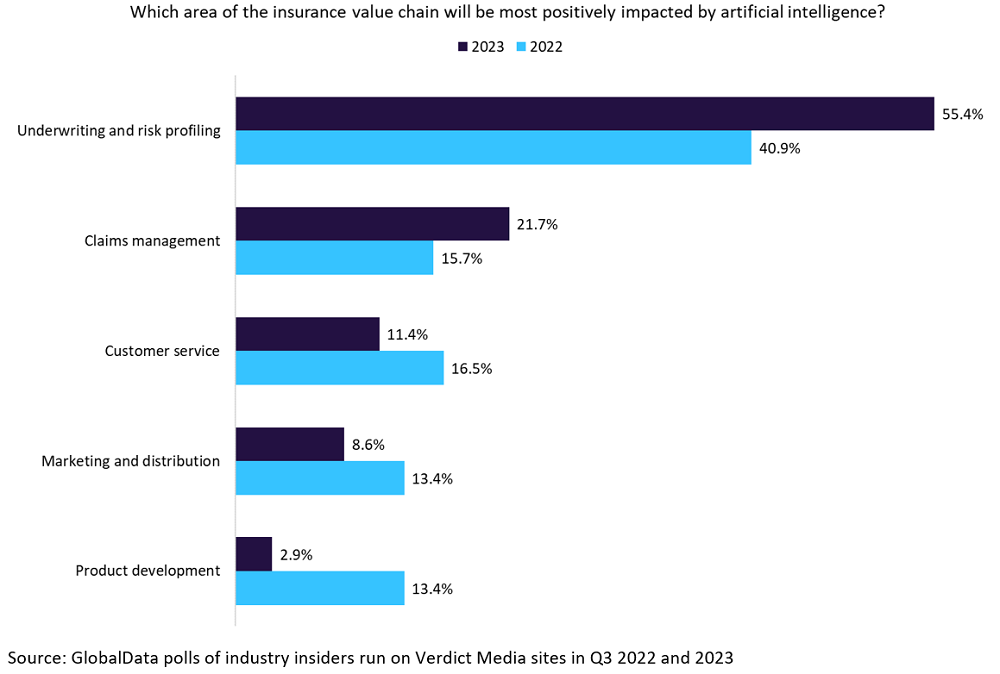

Over the past year, the insurance industry (as well as wider society) has become more attuned to the workings and results of the technology through corporate trials and prolific media coverage. The majority of respondents to our poll suggested that underwriting and risk assessment is the area in which AI will have the most positive impact on the industry (55.4%—up from 40.9% the previous year). Claims management is also regarded as a key area for disruption, as noted by 21.7% of respondents, a rise of six percentage points from last year. These two increases suggest that the industry is starting to zero in on the key areas in which AI will play a key role for the industry going forward. Moving away from trying to utilise the technology across all areas of the value chain, the industry is now finding the greatest benefits will come largely in these two segments.

There are certain areas in which the underwriting process, from application submission to policy issuance, can be streamlined and improved through the application of AI models. Reducing human and employee touchpoints across the process will enhance accuracy (machines do not get tired or bored, nor do they make mistakes) and free up time capacity for underwriters to dedicate themselves to more meaningful or complex tasks.

As with underwriting, the claims management process is highly labor-intensive with considerable time spent on trivial tasks including admin and processing simple claims. AI is becoming established within this segment of the value chain as it offers faster processing of basic claims and allows handlers to focus on more complex cases. AI can automate claims processes from first notice of loss (FNOL) through to payout, an advantage often marketed by leading insurtech firms (such as Lemonade, a market leader within this space). Over time, insurers will be able to ascertain how much funding to allocate to claims reserves as the technology will be capable of predicting, to high degrees of accuracy, the expected claims payouts in a given period.

Ultimately, the usage of AI in underwriting and risk profiling will drive greater customer satisfaction through faster and more effective customer service and greater personalisation of products. Faster claim settlements, targeted investigations, and proactive management of the claims cycle can help insurers to cut costs and eliminate frictions and inefficiencies in current systems.