The impact of climate change is one of the biggest challenges faced by home insurers; it has hardened the market and reduced capacity, with one in five US citizens being denied home insurance as per a GlobalData survey. New solutions that can help underwriters assess risks and price policies accurately will be needed to rebuild capacity.

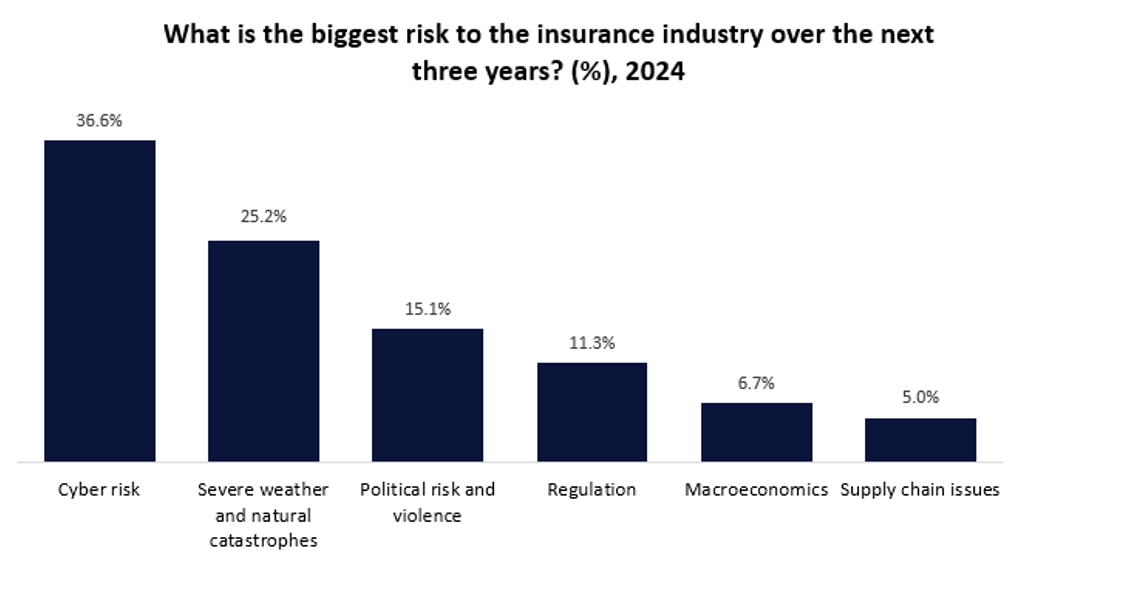

Severe weather events and natural catastrophes are some of the biggest challenges faced by the insurance industry. A GlobalData poll conducted on Verdict Media sites in Q2 2024 found that 25.2% of insurance industry executives believe severe weather and natural catastrophes will be the biggest threat to the industry over the next three years, second only to cyber threats at 36.6%. Severe weather/natural catastrophes significantly outranked threats such as political risk and violence (15.1%) and regulation (11.3%).

Not only has the frequency and severity of weather events and natural hazards surged, but their unpredictability is posing challenges to underwriters to assess and predict risks accurately. While many insurers have increased their premium rates in response to the ever-increasing cost of claims brought about by severe weather events and natural disasters, others have pulled back capacity altogether. For instance, in the US—which is one of the worst-hit countries when it comes to severe weather events—19.3% of citizens have previously been denied home insurance as per GlobalData’s 2024 Emerging Trends Insurance Consumer Survey. Over half (57.7%) believe that this was in connection to the property being in a risk-prone location, such as a high flood risk area or a coastal area.

There is a need for innovative solutions to tackle the challenges the industry is facing, particularly as the frequency of these devastating events is only bound to worsen as climate change accelerates. In this respect, Aon launched the Florida Flood v3.0 model for assessing flood risks in Florida. This open, multi-vendor platform offers high-resolution hazard footprints to help reinsurers quantify flood risks (such as riverine, surface flooding, and tropical cyclone storms) from various weather systems. The model incorporates 92,000 non-tropical and 56,000 tropical cyclone events.

Insurers have traditionally relied on copious amounts of historical data to predict and apportion risks, but the unpredictability of severe weather events has made it difficult for many to price policies correctly. As such, the incorporation of new models and tools that can support insurers’ confidence in the assessment of these events and improve the accuracy of policy pricing will only be beneficial to the industry and help restore capacity in the market over the long term. More innovative solutions will emerge as the impact of climate change becomes increasingly noticeable