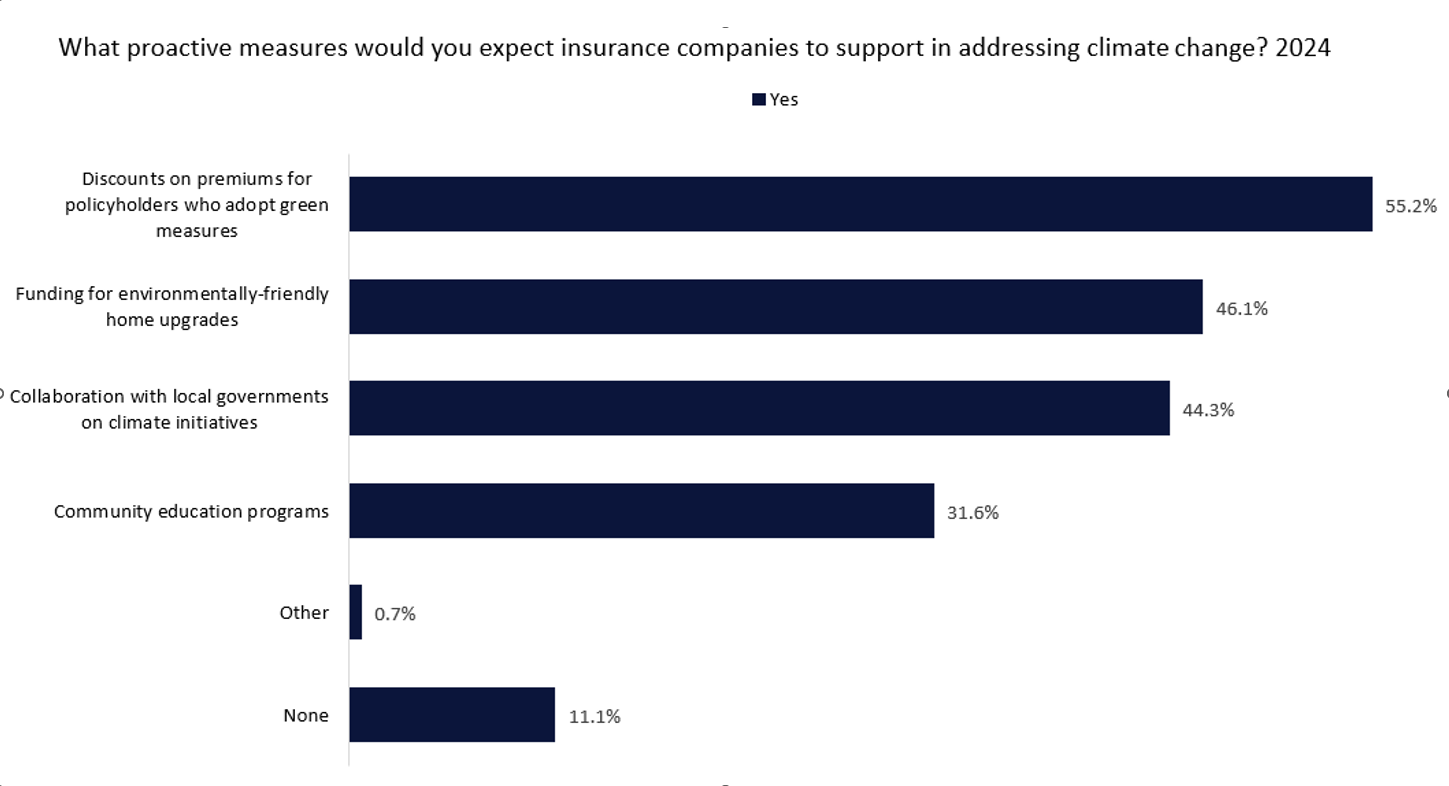

Over half of global consumers believe insurance companies have a role to play in the fight against climate change, according to GlobalData’s new survey. Offering discounts to policyholders who adopt green measures is seen as the fairer proactive measure that insurers should undertake, but other measures are also regarded favourably.

GlobalData’s 2024 Emerging Trends Insurance Consumer Survey found that 77% of consumers around the world are either concerned or very concerned about global warming, and over half (51.3%) think insurers have a role to play in tackling climate change. Insurers are taking steps to reduce their carbon footprint and improve their environmental, social, and governance (ESG) credentials, but they are also coming under pressure to do so from activist groups, investors, regulators, and consumers who expect entities to be more sociably responsible. While insurers are already implementing several proactive measures in the fight against climate change, the largest proportion (55.2%) of consumers believe insurers should offer discounts to policyholders who adopt green measures. Such measures could include making green home improvements or using renewable energy.

In a move to support the conservation of natural species and increase biodiversity, British insurer Aviva has teamed with local charities St. Nicks and York Cares to create a floating ecosystem for wildlife in the river Ouse in York. Together, they have installed a floating structure made from recycled, non-toxic materials that moves up and down with the water levels. Its several layers support the life of various plants and animals. While consumers would naturally want to see better returns for their policies, the move will undoubtedly be welcomed by the local community. Indeed, many consumers also believe that collaborating with local governments and entities on climate change initiatives is another proactive measure that insurers should undertake. Aviva’s move is an example of how leading insurers are becoming more involved in initiatives to support the environment as entities become more conscious about the role they play in supporting sustainability. Moves such as this one from Aviva will naturally help to change both activist groups’ and consumers’ perceptions of insurers. Initiatives such as this will not only have a positive impact on insurers’ ESG credentials but may even help them win more customers and help with their sales.