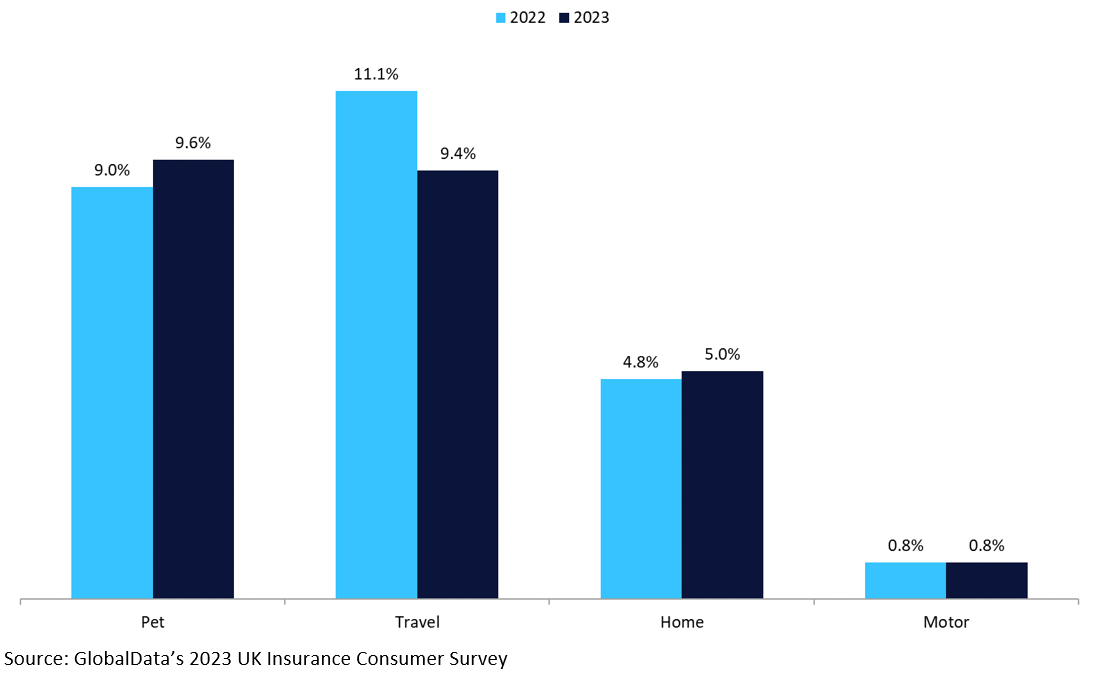

GlobalData’s UK Insurance Consumer Survey indicates that the cost-of-living crisis is still driving many cancellations across personal insurance lines. In 2023, almost 10% of pet and travel insurance customers cancelled a policy, with many of these consumers saying they did so to cut costs or because they were offered significantly higher premiums at renewal.

Although disinflation in the UK economy suggests there is some light at the end of the tunnel, many UK consumers have resorted to insurance policy cancellations to reduce their costs. As of 2022, pet and travel policies are deemed to be the most expendable personal lines products to consumers, with almost 10% of customers making cancellations. In the pet line, 54.1% of these cancellations were made to cut costs while 30% were because the customer’s provider offered significantly higher premiums at renewal.

Herein lies the key challenge for the insurance industry in the coming period: Spiraling costs across most lines are increasing claim costs, while many consumers are unable to afford the requisite premiums needed to support those higher costs. According to the Office for National Statistics, the UK veterinary and other services cost index reached 153.3 in October 2022 (January 2015 = 100). These costs have escalated rapidly since the start of 2022, illustrating the challenge for insurers when it comes to claims payouts and the subsequent difficulties for consumers in affording insurance.

In the travel line, there has been a fall in the proportion of consumers making policy cancellations. With much greater travel freedoms (and a negligible possibility of new COVID-related restrictions), the travel sector has rebounded. With more travel in 2023, there is a reduced likelihood of consumers wanting to be without their travel insurance policy. However, among those who cancelled travel insurance, 40.2% did so as they wanted to cut costs.

In line with this trend, there has been tangible growth in single-trip policies sold as a proportion of all travel policies since the reopening of the travel sector. According to the Association of British Insurers, 36.1% of travel policies sold in 2022 were single-trip policies, compared to 22.6% in 2019. The growth in these policies is likely due to consumers increasingly seeking value for money, especially if they only travel once or twice a year.

The cost-of-living crisis has led to many policy cancellations across personal lines as consumers cut costs or seek cheaper alternatives. The growth of single-trip policies in the travel line provides evidence that offering more affordable alternatives to consumers can be a good way of maintaining business through these challenging financial times. Co-insurance policies in the pet line could offer a way forward for players in the sector in a similar vein. Providers willing to adapt to the changing demands and behaviors of customers in 2023 and beyond are likely to be in a stronger position to grow once the economy returns to normality.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData