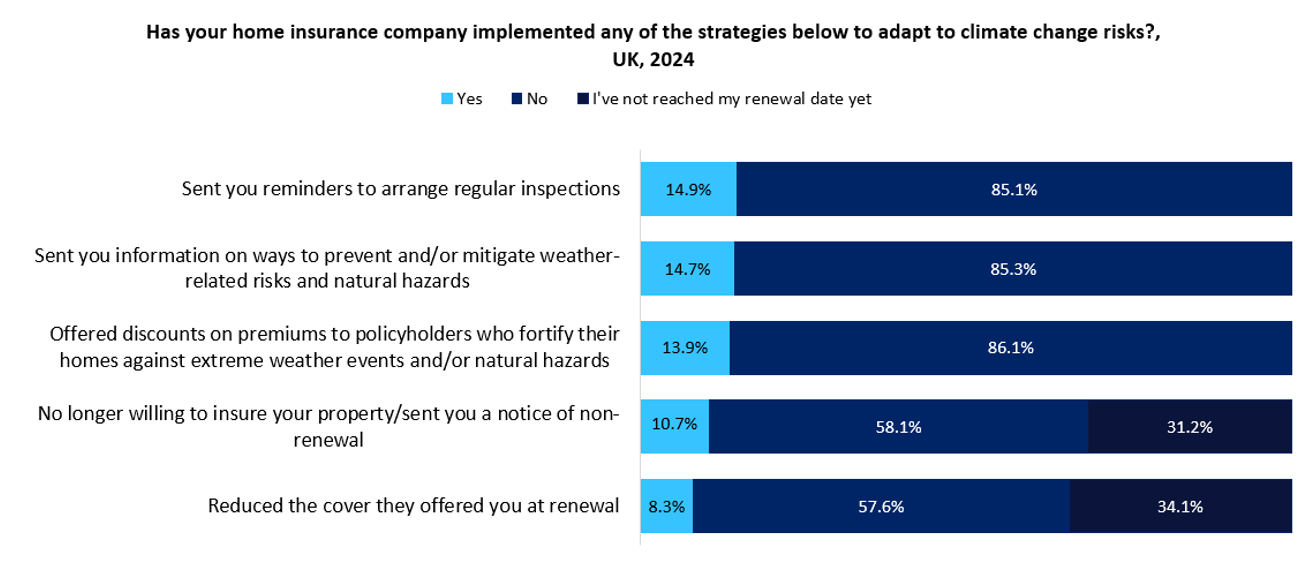

Only a small proportion of home insurance policyholders cite that their insurer has adopted strategies to address climate change risks as per a GlobalData survey. While insurers focus on improving risk assessments to more accurately price policies, more could be done to encourage customers to also take steps that could help mitigate risks and reduce the cost of claims.

According to GlobalData’s 2024 Emerging Trends Insurance Consumer Survey, 14.9% of UK home insurance policyholders receive reminders from their providers to arrange regular home inspections, such as to check their home’s structural integrity. This is the most common action to adapt to climate change risks implemented by insurers as identified by consumers. A similar proportion (14.7%) stated that they receive information on ways to prevent and/or mitigate weather-related risks and natural disasters, such as installing impact-resistant glass windows or suggesting upgrades to their home with advanced construction materials.

Undeniably, climate change is worsening the frequency and severity of weather events and natural disasters. In recent years, some property and casualty insurers have increased their premiums while others have reduced their capacity, limiting the coverage they offer. Increasingly, insurers and reinsurers are trying to turn to advanced data models to predict weather risks more accurately. In November 2024, reinsurer SCOR announced it would provide two years of funding for Lancaster University Management School to enhance its Climate Risk and Uncertainty Collective Intelligence Aggregation Laboratory (CRUCIAL). CRUCIAL will leverage diverse data sets to forecast weather events such as hurricanes.

Improving climate risk assessments through more robust forecasting will enable underwriters to assess and predict risks with enhanced accuracy. While insurers have relied on vast amounts of data to assess risks, the unpredictability of weather events as climate change advances makes this data less unreliable and inherently less useful. While insurers should continue to look into ways to adopt more robust data and models, they can also look at rolling out strategies that customers can adopt to mitigate weather-related risks and, in turn, reduce the cost of claims. In fact, further data from GlobalData’s 2024 Emerging Trends Insurance Consumer Survey shows that 61.6% of UK consumers would find it desirable or very desirable to receive alerts from their home insurer to help prevent weather-related damage to their property. Alerts could help with early detection of risks, such as water leaks and compromised building structures, which could reduce the likelihood of major claims. Meanwhile, the implementation of alerts through digital channels such as apps could improve policyholders’ engagement.