GlobalData surveying has found that younger consumers are more likely to pay for their motor insurance via monthly payments. However, doing so can result in them paying more for the product, as recently highlighted by Money Saving Expert’s Martin Lewis.

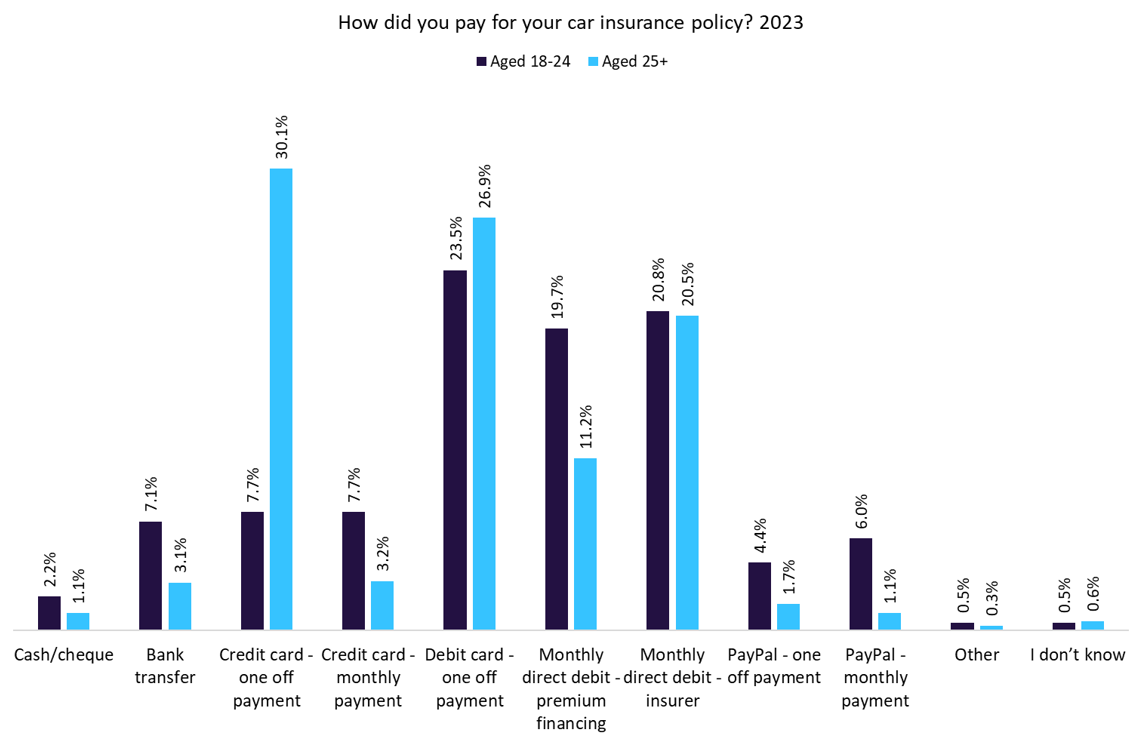

As per GlobalData’s 2023 UK Insurance Consumer Survey, 19.7% of consumers aged 18–24 use monthly direct debit (premium financing) to pay for their motor insurance. This compares with just 11.2% of consumers aged 25+. Moreover, those aged 18–24 are more likely to pay for their car insurance by credit card monthly payments (7.7%), PayPal monthly payments (6%), and a monthly direct debit with the insurer (20.8%).

Younger consumers are more likely to opt for monthly payments for their motor insurance for various reasons. One key factor is the financial flexibility instalments offer to individuals who may not have a lump sum available to pay for their insurance upfront. Younger consumers, particularly those in the 18–24 age group, may be more likely to be in entry-level jobs or still studying, meaning it is easier for them to manage their budget on a monthly basis rather than make a large one-time payment. Additionally, the convenience of spreading out the cost over several months can be appealing to those who prefer to have more control over their cash flow.

However, there are implications to consider when choosing monthly motor insurance payments, as highlighted by Lewis. By opting for monthly payments, consumers may end up paying more in the long run due to the high interest rates that are typically associated with this payment method. Lewis warns that the interest rates on monthly motor insurance payments can range from 10% to 20%, which is significantly higher than one would typically pay on a high-street credit card. This means consumers could end up spending more on their insurance policy overall, making it a less cost-effective option compared to paying in full upfront.

Insurers can take steps to address the trend of younger consumers opting for monthly motor insurance payments and the associated implications. Insurers could educate consumers, particularly younger ones, on the potential cost savings of paying for their insurance in full and the impact of high interest rates on monthly payments. By offering transparent information and guidance, insurers can help consumers make more informed decisions about their payment options and ultimately save money on their motor insurance premiums.