B3i and Its Role in Blockchain Insurance

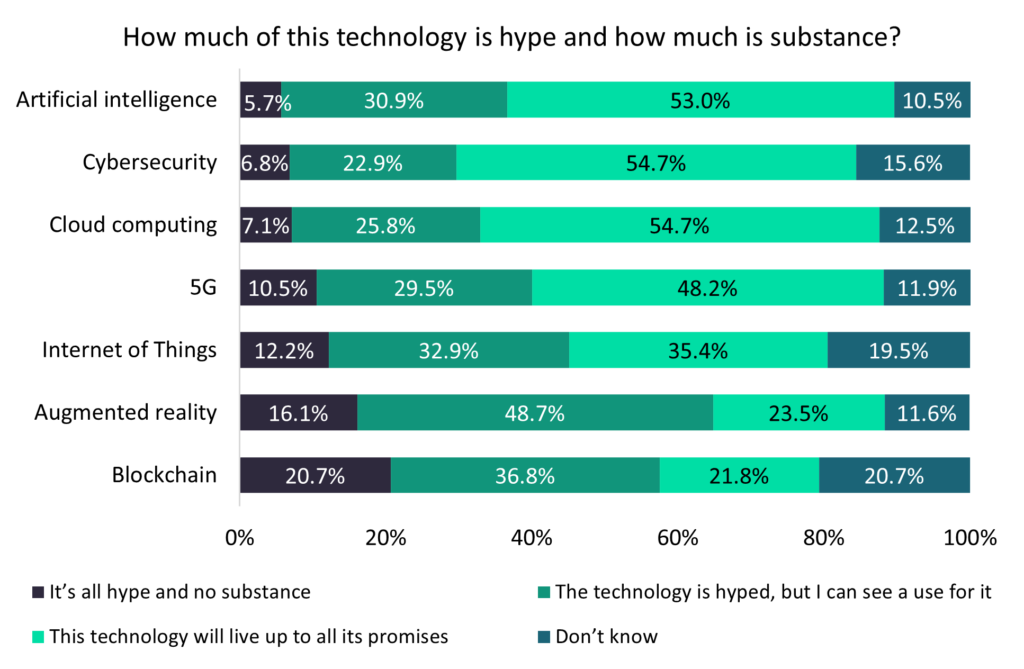

GlobalData’s Q2 2022 Emerging Technology Trends Survey indicates that over 20% of global executives believe blockchain technology is all hype and no substance. The collapse of the Blockchain Insurance Industry Initiative (B3i) leaves a question mark for the role of blockchain technology within the industry. Having begun operating in May 2016, and latterly consisting of over 40 major (re)insurance players, the development could be seen as a blow to the technology in insurance.

Out of seven upcoming but leading technologies, blockchain was most widely believed to lack any real industry use cases by business executives. This can be attributed to several factors. Firstly, the understanding of the technology itself: 20.7% of respondents answered “don’t know” regarding blockchain’s use cases, suggesting that the technology remains poorly defined or misunderstood across industries.

In insurance, B3i’s blockchain technology was successfully implemented in April 2022 when Allianz and Swiss Re placed the first Excess of Loss reinsurance contract using distributed ledger technology. Yet despite this, there may be a belief that the initiative lost sight of its original task of adding end-to-end efficiency, with none of the many large players involved in the project showing any intentions of a revival.

Source: GlobalData’s Q2 2022 Emerging Technology Trends Survey

Secondly, blockchain technology faces a battle to overcome the negative connotations from its association with volatile crypto assets. In another question from GlobalData’s Q2 2022 Emerging Technology Trends Survey, respondents were asked how their sentiment towards the seven technologies had changed in the past year. 32.4% of respondents indicated that their sentiment towards blockchain is more negative than it was compared to the year before – the highest of all technologies in question. B3i’s failure could be associated with the hype that had previously surrounded blockchain in the past, with many leading innovators perhaps not finding as many uses for the technology as originally thought.

Even with B3i’s downfall, use cases of blockchain technology in insurance do persist, most notably within parametric insurance for natural hazards and catastrophes. The continued rise of cryptocurrencies and other digital assets will ensure that blockchain is here to stay. Although the technology has been somewhat disparaged by the industry, disregarding its capabilities and potential completely may see some insurers fall behind the technology curve as its uses slowly grow. The emergence of Chainproof, a regulated smart contract insurance provider, may also help to alleviate concerns surrounding the lack of regulation and enforceability associated with the technology.