Nearly a third of SMEs in the UK believe that the cyber risk they face has increased as a result of the coronavirus pandemic, which should lead to growth in the cyber insurance market.

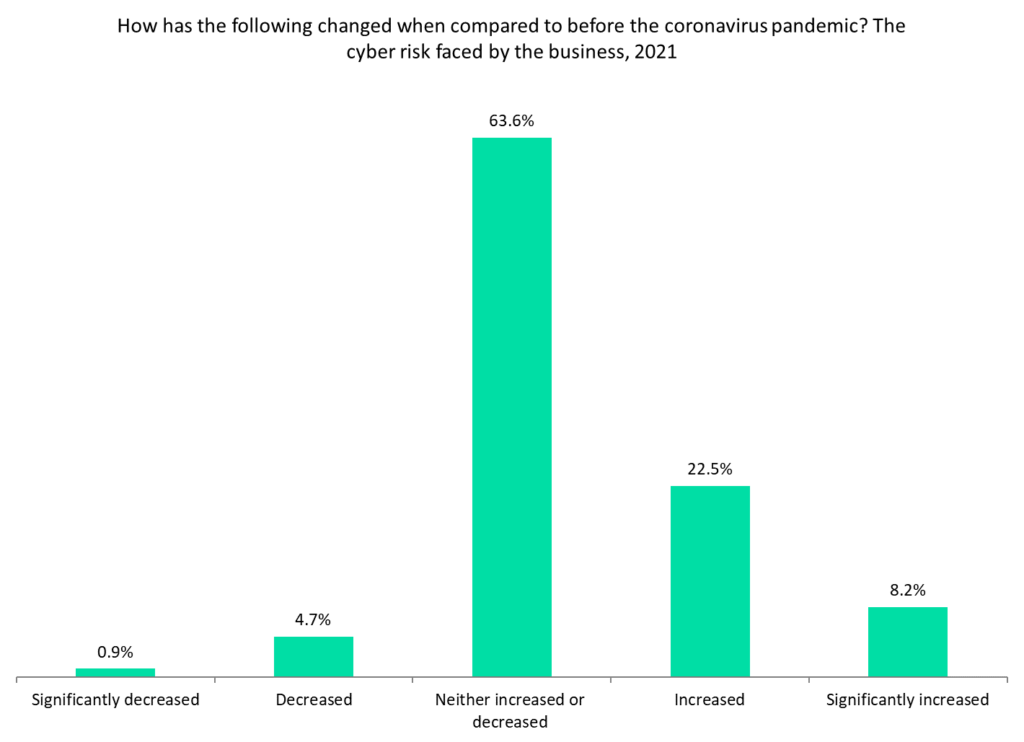

According to GlobalData’s 2021 UK SME Insurance Survey, 30.7% of SMEs cite that the cyber risk they face had either increased or significantly increased because of the pandemic. This is compared to just 5.5% who said the threat had decreased or significantly decreased. While the majority (63.6%) perceived that the threat level had remained the same, it emphasises the potential size of the cyber insurance market that close to a third of SMEs have become more concerned about the threat within the last year and a half.

This increase in concern from businesses has been matched by insurer activity, as they have realised the potential for growth in the market. A recent example is Zurich investing in Toronto-based cyber insurtech BOXX Insurance in September 2021. BOXX provides cybersecurity and insurance to SMEs and consumers. GlobalData’s SME survey data suggests it is the exact type of insurer that will see its demand increase as a result of the changing landscape since the start of the COVID-19 pandemic.

This is a clear example of one of many ways in which the pandemic will change society and as a result have an impact on insurance markets. More people working from home, whether for a couple of days a week or full-time, makes staff more vulnerable to phishing attempts and therefore companies more susceptible to cyberattacks. Therefore, insurers offering preventative policies that can help educate staff and prevent extremely damaging attacks should see considerable interest in the coming years.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData