A surge in climate activism escalates the risk that legal action may be taken against insurers around their environmental commitments. Despite this, GlobalData findings show that only 16% of insurers believe the environmental, social, and governance (ESG) theme will impact their business the most in the next 12 months.

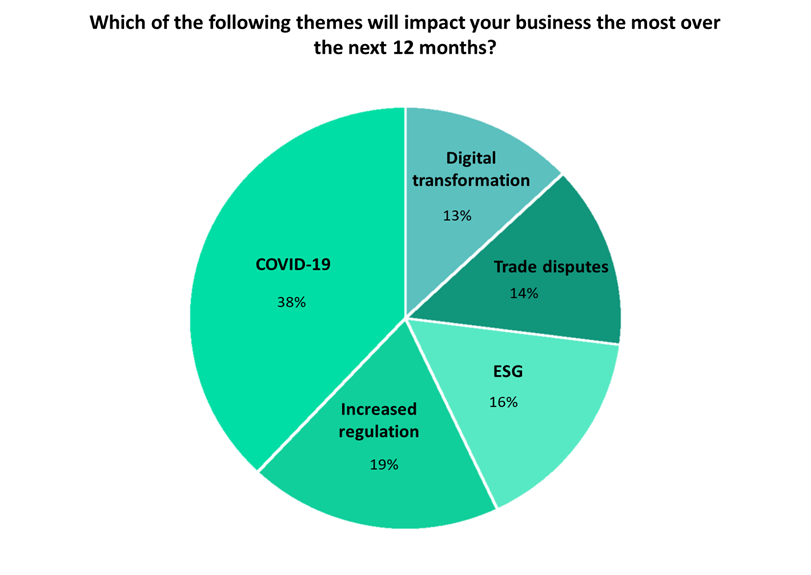

GlobalData’s Q1 2022 ESG Sentiment Poll shows that respondents believe COVID-19 (38%) and increased regulation (19%) will impact their business the most in the next 12 months. ESG only received 16% of the vote, suggesting it is considered by many businesses as tomorrow’s problem – a theme that will have a significant impact over the next decade but limited impact in the short term.

Increased climate activism and the recent ClientEarth vs. Shell case illustrate the escalating risk facing insurers. On March 15, 2022, ClientEarth started legal action against Shell’s board of directors, arguing that their failure to properly prepare the company for net zero puts them in breach of their legal duties.

Despite the ClientEarth vs. Shell case being a novel suit, activist shareholder claims are becoming increasingly common. Grantham Institute’s 2021 Global Trends in Climate Change Litigation Policy report highlights the scope of the problem. Between 1986 and 2014 just over 800 cases were filed; a further 1,000 have since been brought to the courts. Even financial institutions are coming under pressure. For example, Extinction Rebellion protesters forced the closure of Lloyd’s of London in April 2022, demanding that Lloyd’s stops insuring fossil fuel projects.

Insurance companies should be aware of potential public pressure surrounding the insurance of certain entities that are viewed to be neglecting their environmental commitments. Leading insurers all have target dates for when they will stop working with companies making certain percentages of profit through non-renewable energy sources, such as coal, oil, and gas. But they often face pressure for acting too slowly.

All aspects of ESG are receiving greater levels of attention. The COVID-19 pandemic and the current cost-of-living crisis have undoubtedly put social and governance aspects under the microscope. Despite this, GlobalData’s Q1 2022 ESG Sentiment Poll found that less than half of respondents claimed their company was either introducing strategies to achieve ESG goals (34%) or continuing with existing practices (14%). Additionally, the proportion answering that nothing had been done to achieve ESG goals was 27%, while 25% of respondents did not know if their company had acted on ESG.

Increasingly, investors are applying ESG factors as important determinants for whether or not to invest in specific companies. There is an increasing recognition among investors that ESG issues can have an impact on company value and that the management of these risks can increase economic value for companies and their shareholders.

Furthermore, GlobalData’s 2021 ESG Strategy Survey suggests that engaging with ESG can improve profits: 70% of the 1,500 ESG executives surveyed claimed that setting ESG targets positively impacted revenue. The same survey found that 80% of companies plan to increase their investments to meet ESG goals.

Overall, as insurers face more pressure from activism-related claims and climate protests, they should think about accelerating ESG commitments. The added bonus that strong ESG targets also improve brand image and revenue makes it a win-win for insurers.