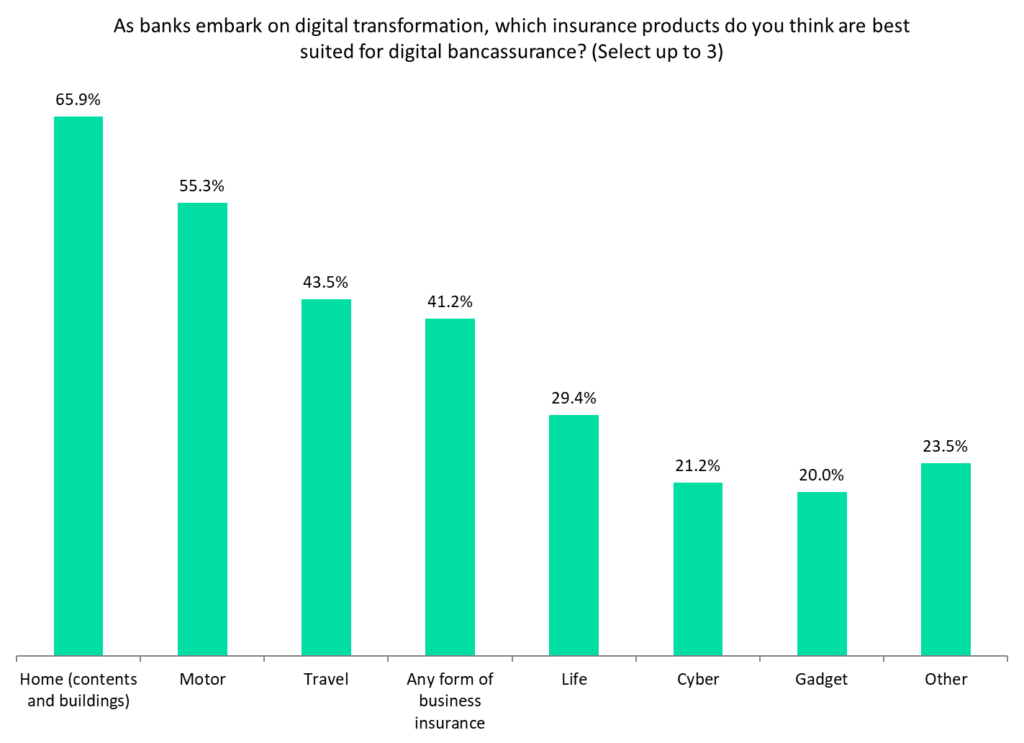

A GlobalData poll in Life Insurance International (LII) found that home, motor, and travel are the three product lines that the digital bancassurance channel should target.

A poll conducted on LII found that respondents felt personal lines were the best suited to the digital bancassurance channel. The 65.9% for home insurance was split between contents (24.7%) and overall home insurance (41.2%), which makes motor insurance the largest individual product. Similarly, “any form of business insurance” was made up from multiple individual products: public liability (7.1%), employers’ liability (5.9%), professional indemnity (4.7%), business interruption (7.1%), private medical (9.4%), and key man (7.1%).

Poll closed November 2021

GlobalData’s 2020 UK Insurance Consumer Survey found that only 3.7% of consumers bought motor insurance through their bank. This rate has been gradually declining since 2018, when it was 4.0%. This poll (which was not region-specific) indicates that people could be interested in this channel if the product was more widely available and accessible via digital platforms.

The poll highlights that there is a wide range of product areas for the bancassurance channel to target. Even niche products such as gadget and cyber insurance received responses of 20% or more, which indicates these could be areas for banks to establish themselves as specialists. It also suggests that consumers might be willing to purchase a range of products from their banks, meaning banks could look to bundle insurance policies together. They could offer consumers home, motor, and travel, for example, or provide SMEs with the essential liabilities products.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData