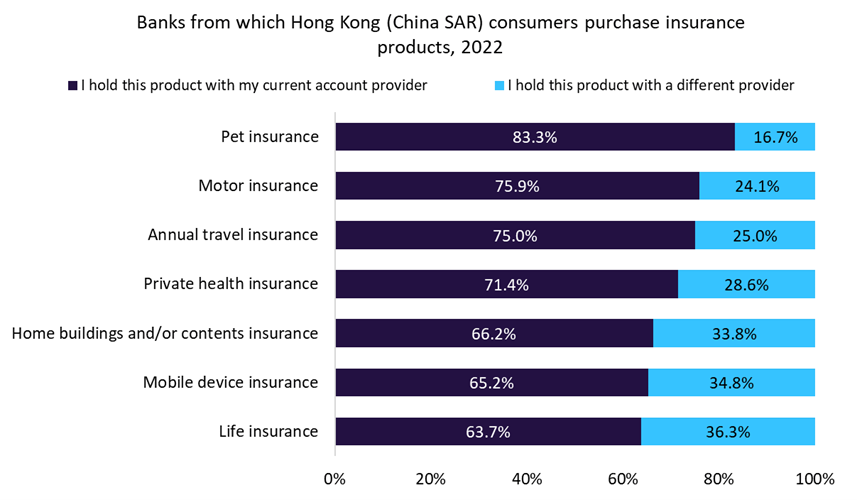

According to GlobalData’s 2022 Financial Services Consumer Survey, over 60% of Hong Kong (China SAR) consumers who buy any insurance product through a bank do so via their current account provider. Chubb’s possible partnership with Hang Seng Bank in Hong Kong (China SAR) will therefore provide good opportunities for the insurer to grow its lines of business.

Gaining access to Hang Seng Bank’s 3.5 million customers would provide Chubb with a key stepping stone into the burgeoning Asia-Pacific market. Further findings from GlobalData’s survey show that over 65% of consumers who purchase non-life insurance through a bank do so via their current account provider. Tapping into this cohort of consumers is clearly a great opening for Chubb to get itself established in Hong Kong (China SAR) before looking at the wider region.

Partnering with a growing bank in the market could serve to further strengthen Chubb’s position over time as this customer base grows. According to GlobalData’s Global Retail Banking Analytics, Hang Seng’s retail deposits in Hong Kong (China SAR) increased 60.8% between 2010 and 2021, rising to $88.7bn. For the bank, partnering with an established insurer could help increase its customer base by opening the door to extra cross-selling opportunities.

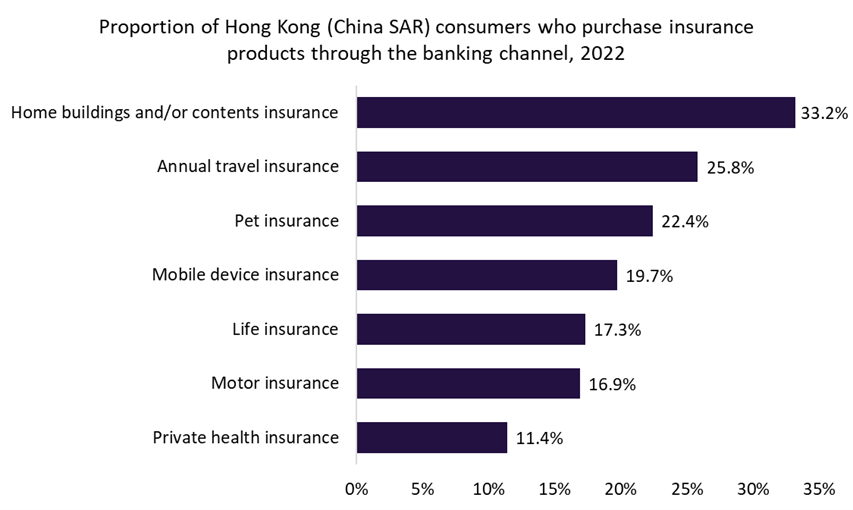

The bank channel is relatively popular for purchasing insurance in Hong Kong (China SAR), with almost a third of consumers purchasing some form of household insurance product through this channel. This provides further evidence that collaborating with a bank would be an excellent avenue for growth for Chubb.

Furthermore, as a key financial hub in the Asia-Pacific region, Chubb’s entrance into the Hong Kong (China SAR) market could open up wider opportunities into other regional markets. In Asia-Pacific as a whole, the banking channel is more widely used for the distribution of insurance products (except pet insurance) than in Hong Kong (China SAR). From 2021 to 2025f, GlobalData forecasts that the Asia-Pacific general insurance market will grow 48.0% to over $800bn. With these partnership discussions, Chubb is taking positive action to enter a market that is ripe for growth.

In order to capitalise, Chubb must ensure it offers products in line with consumer expectations and demands. According to GlobalData’s 2022 Financial Services Consumer Survey, the three most important factors contributing to a high Net Promotor Score for Hong Kong (China SAR) banks are loyalty rewards, competitive prices, and customisable products or features. These aspects apply to both insurance products as well as banking products. If Chubb can meet these criteria, it can certainly meet consumer demand and develop a good foothold in the region.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData