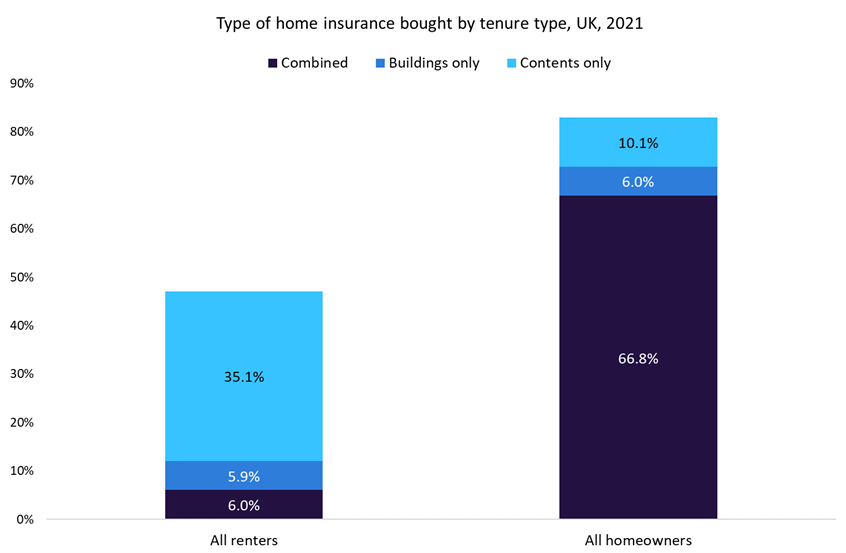

Less than 60% of renters have a contents insurance policy, making the UK an ideal landing ground for Lemonade’s home insurance policies according to GlobalData’s 2021 UK Insurance Consumer Survey. Lemonade’s entry into the UK market will contribute to its success in the coming years despite overall insurtech investment drying up amid the tough economic climate.

Lemonade’s success in the past can be partly attributed to its renters’ insurance product. Renters are less likely to own a home insurance product as many find it too expensive, impractical for renters, or incorrectly assume landlords have cover in place on their behalf. Lemonade’s insurance is designed around younger generations’ needs – it is 100% digital, offering fast signup and free cancellation. The use of artificial intelligence-based tools on both the front- and back-end increases efficiency and helps reduce costs – savings Lemonade can impart to its customers.

As the cost-of-living crisis continues to impact consumers across the UK, renters may be inclined to turn towards Lemonade, with its contents insurance starting at GBP4 ($4.50) a month. The rental market has huge potential in the UK – just over 35% of the 8.4 million rented households in the UK have contents insurance. By targeting this demographic, Lemonade will be sure to make a concerted impact in the UK household line. A key challenge for Lemonade will be convincing renters without insurance that its product is a worthwhile expense. Tapping into this segment of the rental demographic will be key to Lemonade’s success in the UK.

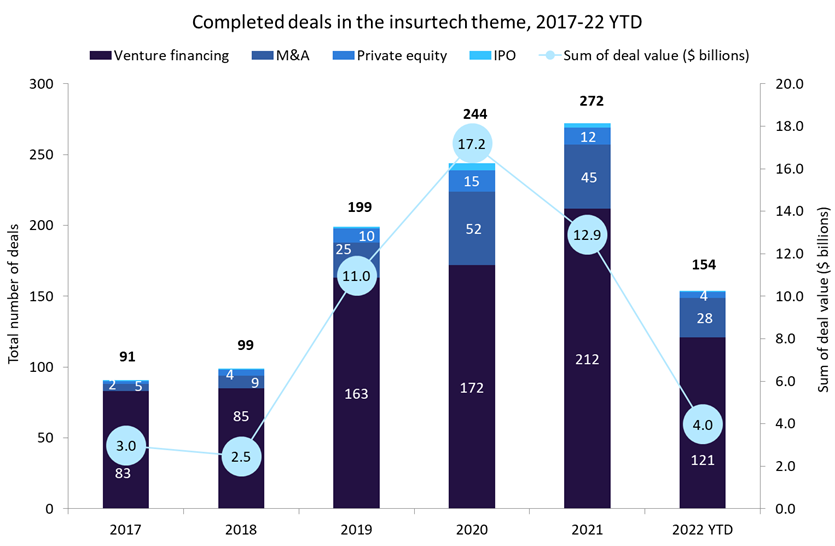

While the entrance of Lemonade into the UK market can be considered a positive for consumers, the firm itself will hold high hopes for the move. According to GlobalData’s Deals Database, the year-to-date (YTD) value of investment in the insurtech theme by October 4, 2022 was just $4bn. For the whole of 2021, this value stood at $12.9bn. As the economic downturn begins to turn investors towards more traditional (and safe) investment vehicles, the insurtech space has started to feel the strain of lower investment into the sector.

Like many other insurtechs, Lemonade is now facing a race for profitability and healthy performance as investor cash becomes less readily available. As a result, insurtechs are now challenged to reduce cash burn, increase profitability, or achieve both in order to survive the incoming recession. If Lemonade can weather the recessional storm and emerge as a well-diversified and profit-making enterprise, it is sure to become a more familiar name in the household insurance sector. According to GlobalData’s 2021 UK Insurance Consumer Survey, just 8.9% of UK consumers knew the Lemonade brand name, illustrating how far it still has to go to reach wider recognition in the market.

Source: GlobalData’s Deals Database

As Lemonade’s renters’ insurance product takes hold in the UK, the insurer will likely look to introduce more of its products, including the pet and motor insurance it offers in a variety of US states. As a way of breaking into a new market – especially given the financial difficulties of many going into Q4 2022 and beyond – a cheap and simple product aimed at an underserved segment of the market will bring rewards aplenty for the insurer.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData