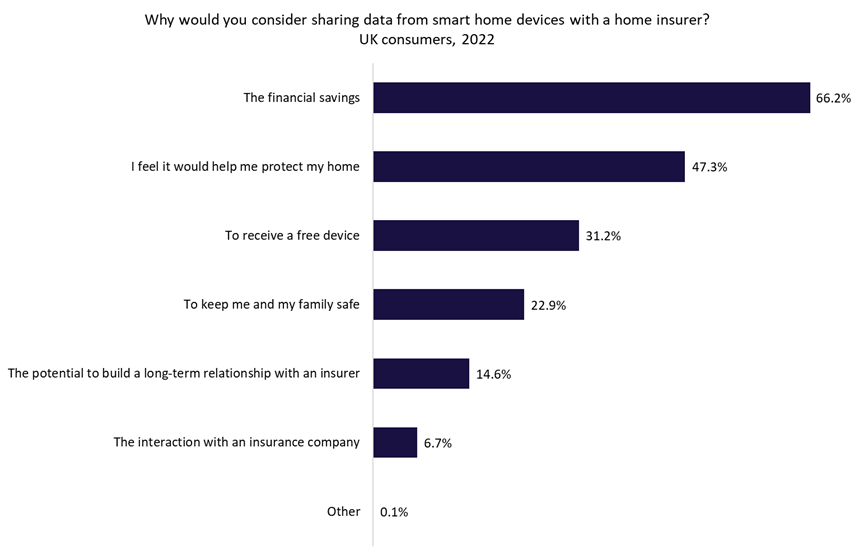

Sky’s smart home insurance policy could change the UK home insurance market with its high level of smart technology integration. GlobalData’s 2022 UK Insurance Consumer Survey suggests that almost two thirds of consumers would be interested in sharing data from a smart device with their home insurer in return for financial savings.

Sky offers a double incentive to customers looking to switch to its new smart home insurance product. Firstly, the consumer receives £250 ($315) worth of smart tech as part of the policy, including a video doorbell, indoor camera, and various sensors (including a leak detector). As per GlobalData’s 2022 UK Insurance Consumer Survey, 31.2% of consumers indicated that receiving a free device would be a sufficient incentive for them to share data with their home insurer, suggesting that such a package could generate early interest.

Secondly, Sky says that existing customers of the whole organisation (such as broadband customers) who purchase the smart home policy will save £5 per month over the two-year insurance contract, totaling £120 worth of savings. This will encourage a large cohort to consider switching, especially when taking into account the ongoing cost-of-living crisis in the UK. The policy is also customisable, with additional extras for basics such as home emergency as well as more modern coverage such as cyber assistance.

Customers who install the smart tech can access all feeds and sensor data via the Sky Protect app, which also allows customers to manage their policy. This will improve customers’ peace of mind, knowing they can monitor their home 24/7 – which is likely to be especially appealing for families. Indeed, 47.3% of customers stated they would share smart data to protect their home and 22.9% stated they would do so to keep themselves and their family safe.

Furthermore, as per GlobalData’s 2022 UK Insurance Consumer Survey, 12.2% of UK home insurance customers stated they would be open to purchasing home insurance from Sky, highlighting a large pool of potential customers.

Sky’s new insurance product is ideal for the demands of more modern and technologically sophisticated consumers. Using smart tech to entice new customers but then utilising it to manage and mitigate claims more effectively (when home insurance claims are in danger of spiraling) could prove to be a model for other home insurers to follow. Sky’s advantage is that it can afford to distribute so much expensive technology as it is not hamstrung by having most of its insurance customers on regular policies. This means its customer base will have smaller risk profiles (as the technology mitigates some claims), impacting claims more immediately than legacy insurers that are gradually looking to integrate smart home products into their offerings. The US has begun to show this strategy’s potential, and now Sky looks set to transform the market in the UK.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData