Health insurers are moving towards health promotion and proactive health cover at the same time as consumers are willing to adopt healthier lifestyle choices for cheaper premiums. Insurers that are creating a more holistic view of health risks, including through the integration of activity-tracking devices, could benefit from healthier customers and see a reduction in the severity of claims.

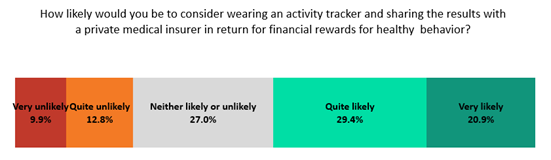

According to GlobalData’s 2021 UK Insurance Consumer Survey, 50.4% of private medical insurance policyholders would be either quite likely or very likely to share the data from an activity tracker or a wearable with an insurer in return for financial rewards. On the other side of the spectrum, a much lower 22.7% of customers are not willing to share data from wearables.

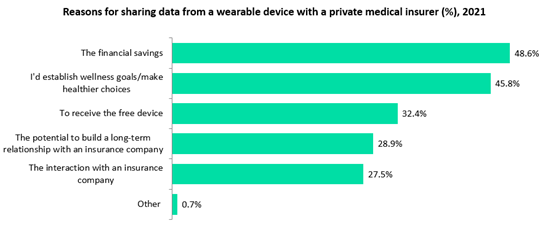

The main reason given to consider sharing wearable data with an insurer was the prospects of financial savings – this was cited by close to half of all individuals and was closely followed by the desire to establish wellness goals and make healthier choices. Indeed, consumers have become more aware of the importance of health and wellbeing since the start of the COVID-19 pandemic.

Source: GlobalData’s 2021 UK Insurance Consumer Survey

The heightened interest in health and wellbeing has also urged an increasing number of providers to enhance their products and improve their wellness solutions. Insurers are taking a more proactive stance, moving towards health promotion and illness prevention in its health cover.

One example is Swiss Re’s recent global partnership with healthtech dacadoo. Under the partnership, Swiss Re will be able to offer insurers access to dacadoo’s portal, which enables end-users to track different activities or connect tracking devices or apps, keeping customers engaged through gamification. Meanwhile, Swiss Re benefits from dacadoo’s real-time ‘health score’, which it generates for users of its portal and is based on their lifestyles, activity levels, nutrition, and sleep, giving a more holistic view of health factors and risks to insurers.

It is clear that insurers have lost interest in merely paying out claims. Given the impact of lifestyle on modifiable risk factors, there is a greater focus on incorporating lifestyle factors into risk assessments, such as using data from tracking devices. Insurers that can better understand customer risks and successfully prompt them to make healthier lifestyle choices could see a fall in the number and severity of claims.