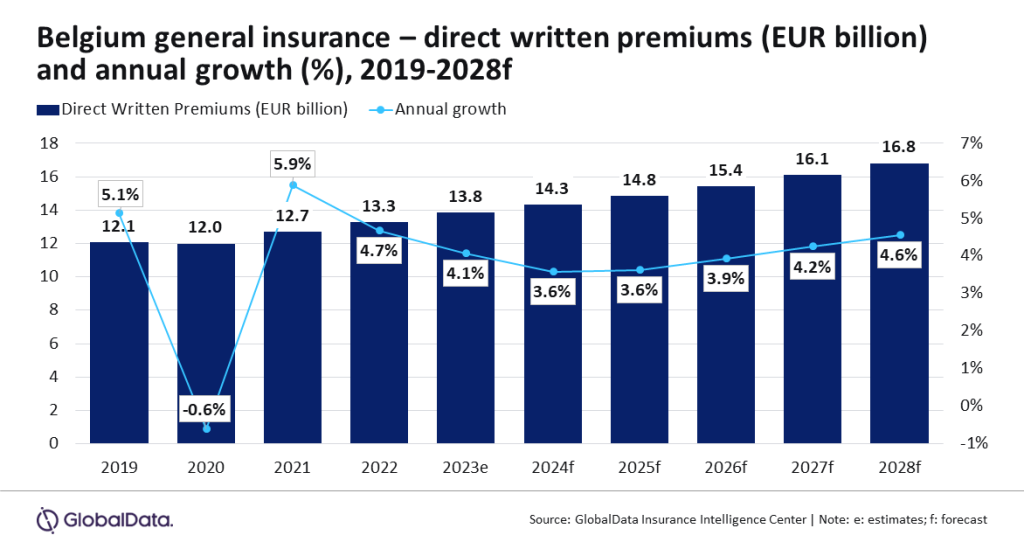

General insurance in Belgium is set to grow at a CAGR of 4.1% from EUR14.3bn ($14.7bn) in 2024 to $17.7bn in 2028 in terms of direct written premiums.

This is according to GlobalData and its Insurance Database, the general insurance industry sector in Belgium is expected to grow by 3.6% in 2024. Motor, property and PA&H will all contribute to this growth as they account for 76.9% of the industry.

Motor insurance has the largest share of general insurance in Belgium, taking up 31.3% of it in 2023.

In addition, motor insurance DWP grew by 1.8% in 2023, supported by an increase in vehicle sales.

Property insurance is the second largest line, accounting for a 25.7% share of the general insurance DWP in 2023.

Furthermore, property insurance grew by 5.1% in 2023, driven by the growing demand for home multi-risk insurance policies, which accounted for a majority share of property insurance premiums in 2023.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataPrasanth Katam, insurance analyst at GlobalData, said: “Belgium has witnessed slower economic growth in 2023, as the real GDP grew by just 1% as compared to 3.2% and 6.3% growth in 2022 and 2021, respectively. As a result, the growth in Belgium’s general insurance industry slowed down in 2023 and grew by 4.1% after growing by 4.7% in 2022. The trend is expected to continue in 2024.

“The high prices of electric vehicles and higher repair costs as compared to Internal combustion engine (ICE) vehicles clubbed with rising inflation levels will prompt insurers to increase the premium prices for motor insurance policies in 2024, which will support the growth of motor insurance. Motor insurance is expected to grow at a CAGR of 2.8% during 2024-2028.

“Smart home sensors that provide real-time alerts for water leaks and other potential damages are promoted by property insurers for early detection of damages and minimising claims. Policyholders, in turn, can obtain premium discounts for adopting smart home technologies.”