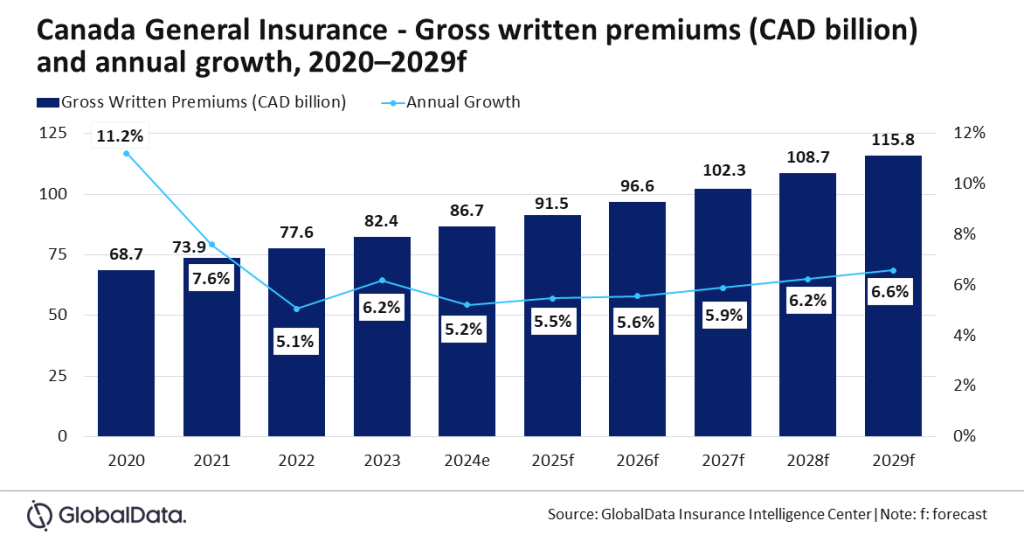

The general insurance sector in Canada is forecast to grow at a CAGR of 6% from CAD86.75bn ($65.12bn) in 2024 to CAD115.82bn ($90.07bn) in 2029, in terms of gross written premiums.

This is according to GlobalData which also predicted that general insurance in Canada will grow by 5.2% in 2024.

In addition, this rise will be driven by an increase in demand for property and motor insurance that are expected to account for nearly three quarters of general insurance premiums in 2024.

Sutirtha Dutta, Insurance Analyst at GlobalData, comments: “The growth in the Canadian general insurance industry is expected to contract slightly in 2024 due to a slowdown in the economy. However, an uptick in the demand for policies covering natural catastrophic (nat-cat) events and growing awareness of high financial implications from cybercrimes will support general insurance growth. The industry growth is expected to rebound from 2025 onwards, supported by a revival in economic growth.”

Property insurance is the leading line of business in the Canadian general insurance industry and is expected to account for a 40.4% share of the general insurance GWP in 2024. It is expected to grow by 5.2% in 2024, driven by home multi-risk and industrial multi-risk policies that account for more than 95% of the GWP share.

Climate change continues to exacerbate nat-cat risks in Canada, which has led to more frequent and severe weather events such as wildfires, flash floods, and storms. According to the Insurance Bureau of Canada (IBC), insured damages from flash floods reached CAD1,192m ($883m) in 2023, while those from wildfires reached CAD696.5m ($940m).

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataDutta adds: “The increasing frequency of such events is expected to drive up the premium prices of these policies, contributing to the growth of property insurance, which is expected to grow at a CAGR of 6.9% during 2025-2029.”