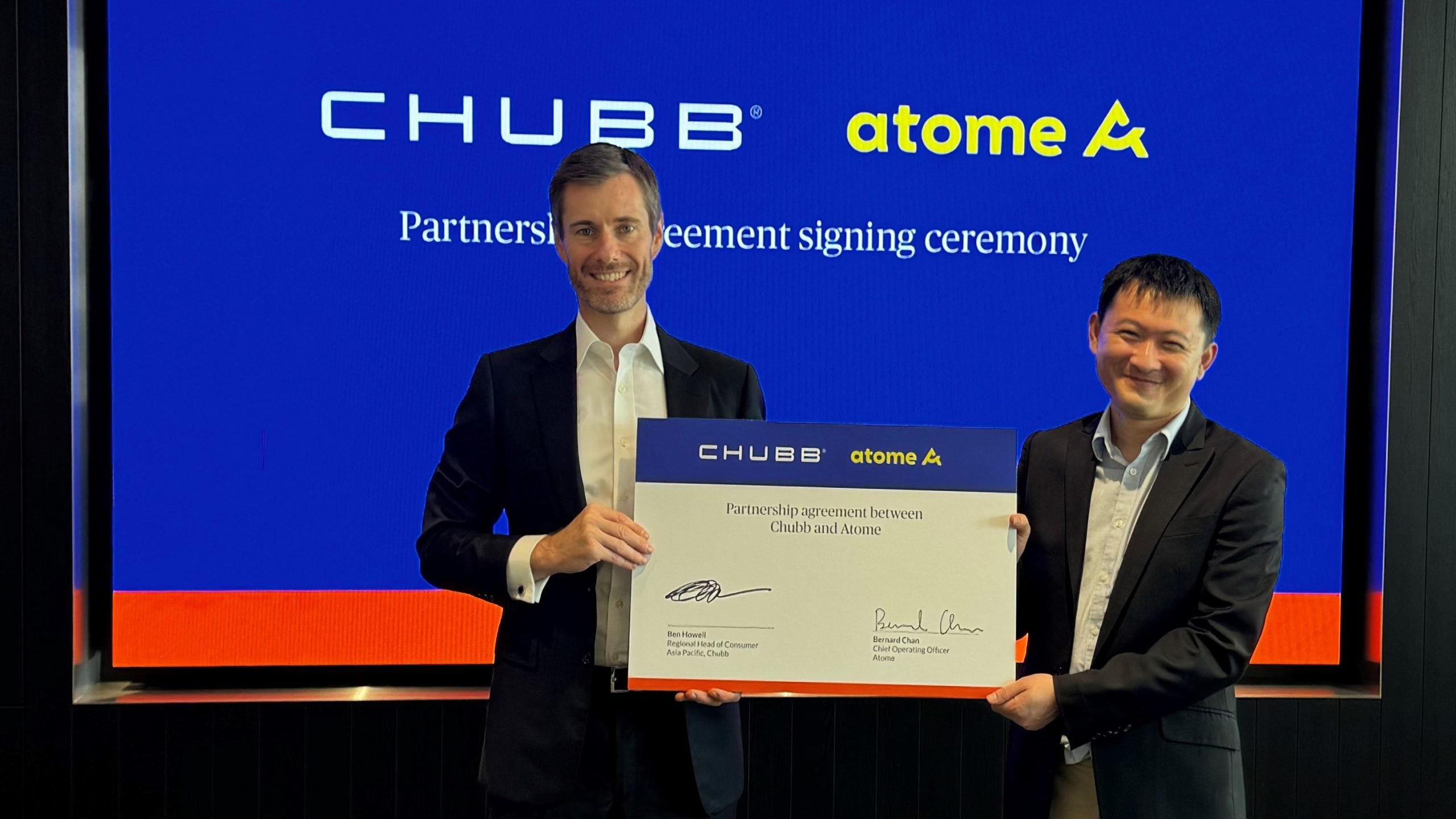

Property and casualty insurance major Chubb has partnered with digital financial services provider Atome to enhance consumer protection in South East Asia.

The collaboration aims to co-develop insurance products for Atome users in Singapore, Malaysia, the Philippines and Indonesia.

The first product from this partnership is currently available in Singapore and will soon be launched in Malaysia.

Called Bill Secure, the insurance product is specifically designed for consumers utilising buy now, pay later services.

It offers coverage of up to five-times the transaction amount in cases of permanent disability or accidental death.

This ensures that the insured or their beneficiaries can settle the payment of the purchased item, with any remaining funds going to the insured’s estate.

In the second quarter of 2024, Chubb and Atome are set to introduce their second product, Shopping Secure.

Chubb regional head of consumer for Asia-Pacific Ben Howell said: “Chubb is committed to broadening consumer protection by introducing relevant, convenient and affordable insurance solutions digitally that protect consumers and their livelihoods.

“With Atome, we are leveraging technology to enable individuals and their families in South East Asia to access essential protection, helping to narrow the insurance protection gap in South East Asia.”

Atome COO Bernard Chan said: “Atome started as a buy now, pay later and embedded financing platform. Today, we have grown to become a digital financial services platform that also includes insurance, cards and lending in various markets.”

Earlier this week, Chubb launched a global transactional risk platform to provide transactional risk liability insurance products in international markets.

Josh Cowen is leading the new initiative as senior vice-president of international transactional risk at Chubb, based in London.