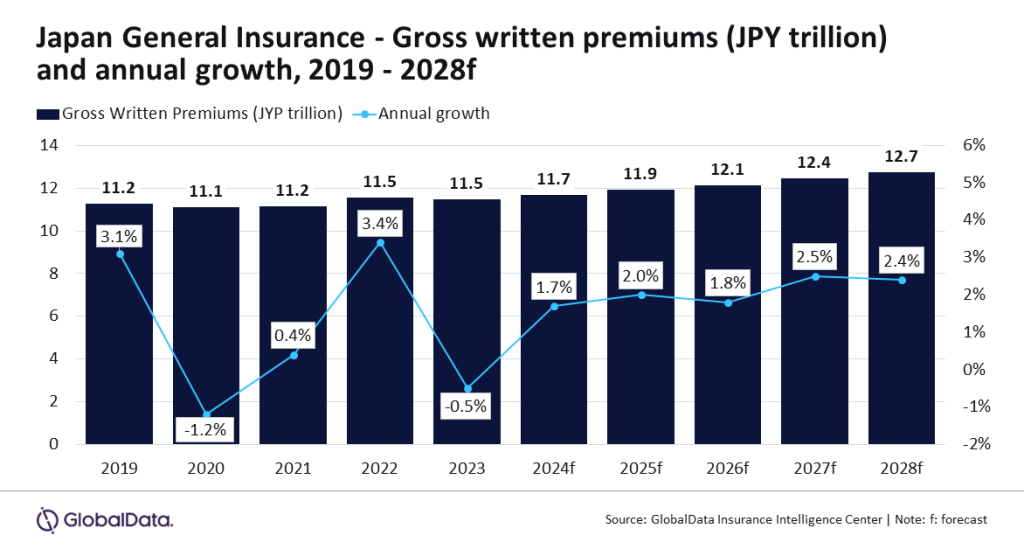

The general insurance industry in Japan is predicted to grow at a compound annual growth rate (CAGR) of 2.2% from JPY11.7trn ($81.1bn) in 2024 to JPY12.7trn ($93.9bn) in 2028, in terms of gross written premiums (GWP).

This is according to GlobalData and its insurance database which also claims that general insurance in Japan will grow by 1.7% in 2024. Demand for natural catastrophe policies and workmen’s compensation will support this.

Sneha Verma, insurance analyst at GlobalData, said: “Japan’s economy went into a recession in early 2024 after witnessing a contraction in the last two quarters of 2023. As a result, the general insurance industry witnessed a decline of 0.5% in 2023 as compared to 3.4% growth in 2022. The growth is expected to rebound in 2024, supported by an increase in premium rates across many general insurance lines driven by high inflation and rising claims due to extreme weather events.”

Motor insurance is the leading arm of general insurance in Japan and is estimated to account for 47.5% share of general insurance GWP in 2024.

Verma adds: “However, a rise in the frequency and severity of extreme weather events over the last few years has led to an increase in claims. As a result, insurers are expected to assess their risk exposure, which can lead to an increase in motor insurance premium rates in 2025.”