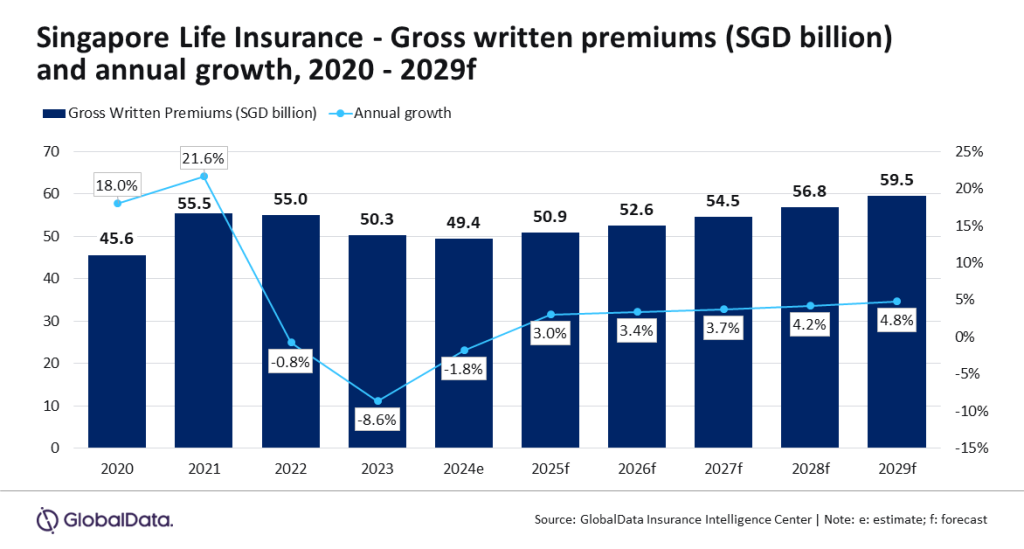

The life insurance industry in Singapore is predicted to grow at a CAGR of 4% over 2025- 29, with gross written premiums increasing from SGD50.9bn ($37.3bn) in 2025 and SGD59.5bn ($43.6bn) in 2029.

This will be driven by an aging population, increasing health awareness, and a revival in consumer spending, according to GlobalData.

In addition, the life insurance industry in Singapore is projected to grow by 3% in 2025 thanks to an economic resurgence that should boost consumer spending. Also, this will be supported by the nation’s demographic shift towards an aging population and demand from customers looking to protect their financial well-being.

Manogna Vangari, Insurance Analyst at GlobalData, comments: “The life insurance industry in Singapore is anticipated to continue its decline in 2024, following a persistent downturn over the past two years. This decline can be attributed to the uncertainty in the global macroeconomic environment, sustained economic volatility, and rising inflation. The industry is expected to gain momentum in 2025, supported by changing demographics and increasing health awareness that will drive the demand for personal accident and health (PA&H), and whole life insurance policies.”

Whole life insurance is the leading line, which is expected to account for 44.0% share of the GWP in 2024. Whole life insurance is expected to decline by 4.1% in 2024, due to high inflation and rising interest rates that have led to a decline in its demand. The inflationary pressure is expected to persist over the short-term.

However, it is expected to rebound and grow by 2.1% in 2025, attributed to the country’s aging population coupled with an increasing life expectancy.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataVangari adds: “A significant portion of whole-life insurance premiums in Singapore are attributed to single-premium policies, a trend fuelled by the country’s substantial affluent demographic.”