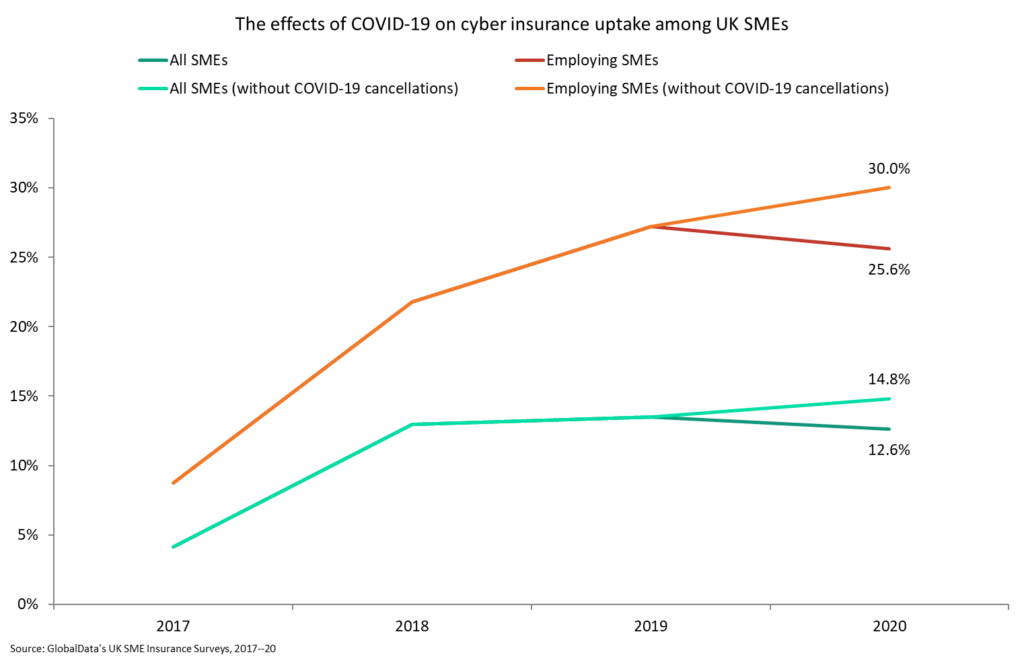

Cyber criminals have been using COVID-19 as a means of carrying out malicious attacks throughout 2020. Despite UK SMEs recognising that cyber risk has increased, a significant proportion of them have cancelled their cyber insurance policy as a result of COVID-19.

12.8% of UK SMEs held a cyber insurance policy in 2020, down 6.7% compared to 2019, according to GlobalData’s 2020 UK SME Insurance Survey. Had it not been for COVID-19, 14.8% of SMEs would have held cyber insurance in 2020, with the majority of SMEs that cancelled their policy doing so in order to cut costs amid COVID-19.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataSole traders are less likely to have a need for cyber insurance. 25.6% of SMEs with at least one employee held cyber insurance in 2020. However, without COVID-19-related cancellations, 30% would have held a policy this year.

The need to cut costs outweighs the increased cyber risk for UK SMEs. 24% of employing SMEs recognise that their business faces a greater level of cyber risk than before coronavirus, but policies are still being cancelled.

However, COVID-19 should be a catalyst to spur growth in the UK cyber insurance market. 16.2% of employing SMEs are now more likely to purchase cyber insurance than they were before the pandemic. This likelihood is greatest among larger SMEs that would typically carry more cyber risk. Just under one third (33%) of medium-sized business (50–250 employees) stated they are now more likely to purchase cyber insurance.

Increases in uptake will come further down the line, however. Businesses are strapped for cash right now, and policies will be more expensive due to the increased risk.