Ceall O’Dunlaing, Chief Technical Officer at Financial Risk Solutions, unpacks the complexities of enterprise technology transformation and demonstrates how the continuous deployment practices are reducing the risks of software upgrades and improvements in the funds industry.

Why is it that improvements in software development and delivery over the past five years seem to be tantalisingly out of reach for many enterprise firms, especially in financial services?

While there is a lot of talk about rolling out modern practices there is little evidence on the ground of real change when it comes to digital transformation. We all know why. The risks associated with change are just not the same across different industries.

What works over there just does not work over here. Industries like financial services, aviation or medical science have low-risk appetites and fault tolerances that need to be close to zero. For regulated financial services firms, the smallest code defect can result in significant financial loss, reputational damage and regulatory fines.

Corporate governance has not yet evolved to champion digital transformation, with structures that measure financial reporting standards, and are constrained by short term time periods and risk cultures that support inaction.

The cost of not being able to leverage new practices into our industry is hard to quantify. It certainly leads to a feeling that the enterprise is standing still, and as each day passes is more susceptible to disruption. This is not a skills issue, but instead the massive investment in technology that has evolved over 30 or 40 years and cannot be rewired to cloud or continuous integration business models without incurring deep uncertain change risks.

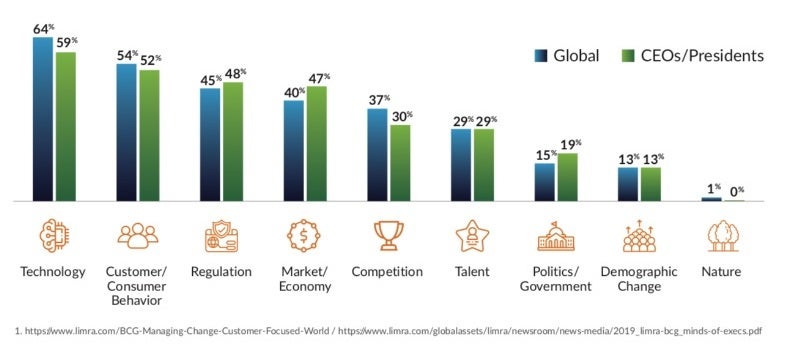

But change is coming, and the industry recognises this. A 2019 study of over 500 insurance C-suite executives by LIMRA and Boston Consulting Group¹ found technology was the most urgent external challenge affecting firms. 64 percent of executives cited it as the top issue in their firm, ahead of customer behaviour and regulation.

Complexity drives uncertainty

Financial enterprise infrastructures are just too complex to mess with, due to the interaction and multiplicity of systems. In the notation of the Cynefin framework, a conceptual framework used to aid decision-making, it is not that any of the individual systems are complicated, after all many of them are quite basic data processing engines, but it is the sheer multiplicity of systems that drives this into the complex sphere and sometimes even into the mildly chaotic category. It is almost impossible to know how the system will behave until AFTER we actually make the change.

Weakest link principles apply here too. The “legacy-ness” of a system can be ascertained by looking at the older parts. While eliminating these might be next to impossible for some core data processing solutions, they should not prevent the enterprise from adopting new delivery methods for old frameworks and creating new efficiencies in other parts of the system.

New software delivery methods for old frameworks

When we looked at where our clients were at when it came to implementing transformation in the middle office, it was easy to see the challenges they were facing. Our customers control over USD 300 billion assets under management (AUM) daily using Invest|ProTM, and this is just one cog within a collection of interoperable, multi-generational technology systems.

Core to our proposition is increasing efficiencies and removing risk in investment administration operations. For us, that means moving users off the desktop and away from manual processing. We define an Optimum Operating Model within the software and provide a modern exceptions-based user interface (UI). In these times of distributed workforces due to the COVID-19 pandemic, the ability to remove the user physically from systems and co-workers has even more relevance.

Last year we implemented virtual continuous software deployment on our client deployments. This required each production environment to be cloned internally and wired into the nightly builds, and then deployed to each clone. We couple this with test automation, with customer-specific scenarios at each clone. These test scenarios replicate integration points within the complex structure of the real-world deployment hence replicating the stresses of the production environments while still enabling the benefits of the continuous integration. Already, over half of our customers are using our continuous deployment service to remove the uncertainty for implementations and upgrades.

Whilst system change and software refreshes are high impact decisions for the enterprise, this is a great example of how a software vendor can, with the correct implementation of continuous deployment practices and test automation, lower the entire system risk. The benefits of change can be analysed and prototyped post-development and pre-delivery. Overall this allows for more frequent refreshes and less effort with reduced risk.

As firms achieve unprecedented growth in assets under management, continuous delivery of software will be critical to raising standards and mitigating the risks that impact our industry.